PG&E 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PG&E Corporation

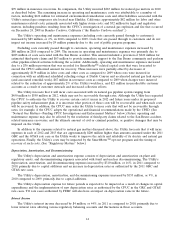

On May 9, 2011, PG&E Corporation entered into an Equity Distribution Agreement providing for the sale of

PG&E Corporation common stock having an aggregate gross sales price of $288 million. On November 28, 2011,

PG&E Corporation entered into a new Equity Distribution Agreement providing for the sale of PG&E Corporation

common stock having an aggregate gross offering price of up to $400 million. Sales of the shares are made by means

of ordinary brokers’ transactions on the New York Stock Exchange, or in such other transactions as agreed upon by

PG&E Corporation and the sales agents and in conformance with applicable securities laws.

For the year ended December 31, 2011, PG&E Corporation sold 9,574,457 shares of common stock under the

May and November Equity Distribution Agreements for cash proceeds of $384 million, net of fees and commissions

paid of $4 million. The proceeds from these sales were used for general corporate purposes, including the infusion of

equity into the Utility. As of December 31, 2011, PG&E Corporation had the ability to issue an additional

$300 million of common stock under the November Equity Distribution Agreement.

In addition, during the year ended December 31, 2011, PG&E Corporation issued 7,222,803 shares of common

stock under its 401(k) plan, its Dividend Reinvestment and Stock Purchase Plan, and upon the exercise of employee

stock options, generating $278 million of cash.

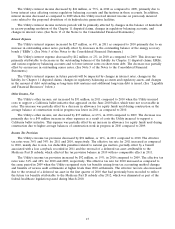

Future Financing Needs

The amount and timing of the Utility’s future debt financings and equity needs will depend on various factors,

including:

• the amount of cash internally generated through normal business operations;

• the timing and amount of forecasted capital expenditures;

• the timing of the resolution of the Chapter 11 disputed claims and the amount of interest on these claims that

the Utility will be required to pay (see Note 13 of the Notes to the Consolidated Financial Statements);

• the timing and amount of payments made to third parties in connection with the San Bruno accident, and the

timing and amount of related insurance recoveries;

• the timing and amount of penalties imposed on the Utility in connection with the various regulatory

proceedings and investigations related to the San Bruno accident and the Utility’s natural gas pipeline system;

• the timing and amount of costs associated with the Utility’s natural gas pipeline system, and the amount that

is not recoverable through rates (see ‘‘Operating and Maintenance’’ above and ‘‘Natural Gas Matters’’ below);

• the amount of future tax payments (see the discussion of the Tax Relief Act under ‘‘Utility—Operating

Activities’’ below); and

• the conditions in the capital markets, and other factors.

PG&E Corporation contributes equity to the Utility as needed to maintain the Utility’s CPUC-authorized capital

structure. The Utility is required to file an application with the CPUC in April 2012 to begin the cost of capital

proceeding in which the CPUC will determine the Utility’s authorized capital structure and rates of return beginning

on January 1, 2013. A change in the Utility’s authorized capital structure also may impact PG&E Corporation’s and

the Utility’s future debt and equity financing needs. (See the ‘‘2012 Cost of Capital Proceeding’’ discussion in

‘‘Regulatory Matters’’ below.)

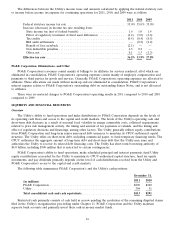

Credit Ratings

PG&E Corporation’s and the Utility’s credit ratings may affect access to the credit and capital markets and the

respective financing costs in those markets. Credit rating downgrades may increase the cost of short-term borrowing,

including commercial paper and the costs associated with the respective credit facilities, and long-term debt.

In December 2011, Standard & Poor’s Ratings Services (‘‘S&P’’) downgraded PG&E Corporation’s and the

Utility’s corporate and senior unsecured debt credit ratings and the Utility’s preferred stock credit rating. The

corporate credit and senior unsecured debt ratings of PG&E Corporation and the Utility remained at investment

grade levels at December 31, 2011.

18