PG&E 2011 Annual Report Download - page 18

Download and view the complete annual report

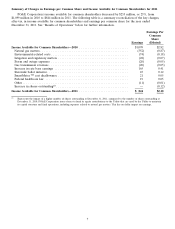

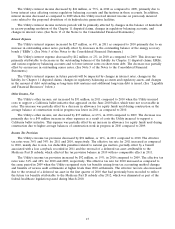

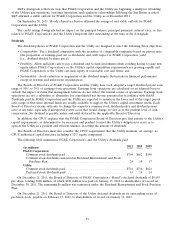

Please find page 18 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$99 million in insurance recoveries. In comparison, the Utility incurred $283 million for natural gas matters in 2010

as described below. The remaining increase in operating and maintenance costs was attributable to a number of

factors, including $122 million for estimated environmental remediation costs and other liabilities associated with the

Utility’s natural gas compressor site located near Hinkley, California; approximately $82 million for labor and other

maintenance-related costs, primarily associated with higher storm costs; and $32 million for legal and regulatory

matters, including penalties resulting from the CPUC’s investigation of a natural gas explosion and fire that occurred

on December 24, 2008 in Rancho Cordova, California (‘‘the Rancho Cordova accident’’.)

The Utility’s operating and maintenance expenses (including costs currently passed through to customers)

increased by $89 million, or 2%, in 2010 compared to 2009. Costs that are passed through to customers and do not

impact net income increased by $9 million primarily due to the cost of public purpose programs.

Excluding costs currently passed through to customers, operating and maintenance expenses increased by

$80 million in 2010 compared to 2009. The increase in operating and maintenance expenses was primarily due to

$283 million of costs associated with the San Bruno accident. This amount included a provision of $220 million for

estimated third-party claims and $63 million to provide immediate support to the San Bruno community and perform

other pipeline-related activities following the accident. Additionally, operating and maintenance expenses increased

due to a $36 million provision that was recorded for SmartMeterTM related capital costs that were forecasted to

exceed the CPUC-authorized amount for recovery. These increases were partially offset by decreases of

approximately $139 million in labor costs and other costs as compared to 2009 when costs were incurred in

connection with an additional scheduled refueling outage at Diablo Canyon and accelerated natural gas leak surveys

(and associated remedial work), $67 million in severance costs as compared to 2009 when charges were incurred

related to the reduction of approximately 2% of the Utility’s workforce, and $21 million in uncollectible customer

accounts as a result of customer outreach and increased collection efforts.

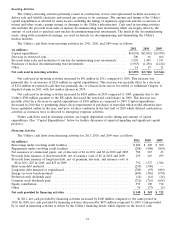

The Utility forecasts that it will incur costs associated with its natural gas pipeline system ranging from

$450 million to $550 million in 2012, which may not be recoverable through rates. Although the Utility has requested

the CPUC to authorize the Utility to recover certain costs it incurs in 2012 and future years under its proposed

pipeline safety enhancement plan, it is uncertain what portion of these costs will be recoverable and when such costs

will be recovered. In addition, the CPUC may order the Utility to incur costs that will not be recoverable through

rates, for example, if the CPUC adopts the operational and financial recommendations made by the CPSD. (See

‘‘Natural Gas Matters—Pending CPUC Investigations and Enforcement Matters’’ below.) Future operating and

maintenance expense may also be affected by the resolution of third-party claims related to the San Bruno accident,

related insurance recoveries, and the ultimate amount of civil or criminal penalties, or punitive damages that may be

imposed on the Utility.

In addition to the expenses related to natural gas matters discussed above, the Utility forecasts that it will incur

expenses in each of 2012 and 2013 that are approximately $200 million higher than amounts assumed under the 2011

GRC and the GT&S rate case as the Utility works to improve the safety and reliability of its electric and natural gas

operations. Finally, the Utility’s costs may be impacted by the SmartMeterTM opt-out program and the timing of

recovery of such costs. (See ‘‘Regulatory Matters’’ below.)

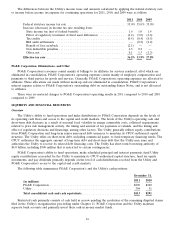

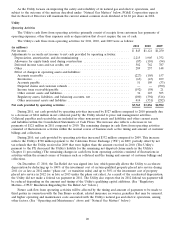

Depreciation, Amortization, and Decommissioning

The Utility’s depreciation and amortization expense consists of depreciation and amortization on plant and

regulatory assets, and decommissioning expenses associated with fossil and nuclear decommissioning. The Utility’s

depreciation, amortization, and decommissioning expenses increased by $310 million, or 16%, in 2011 compared to

2010, primarily due to capital additions and an increase in depreciation rates as authorized by the 2011 GRC and

GT&S rate cases.

The Utility’s depreciation, amortization, and decommissioning expenses increased by $153 million, or 9%, in

2010 compared to 2009, primarily due to capital additions.

The Utility’s depreciation expense for future periods is expected to be impacted as a result of changes in capital

expenditures and the implementation of new depreciation rates as authorized by the CPUC in the GRC and GT&S

rate cases. TO rate cases authorized by FERC will also have an impact on depreciation rates in the future.

Interest Income

The Utility’s interest income decreased by $4 million, or 44%, in 2011 as compared to 2010, primarily due to

lower interest rates affecting various regulatory balancing accounts and fluctuations in those accounts.

14