PG&E 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

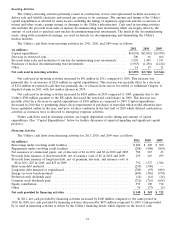

Investing Activities

The Utility’s investing activities primarily consist of construction of new and replacement facilities necessary to

deliver safe and reliable electricity and natural gas services to its customers. The amount and timing of the Utility’s

capital expenditures is affected by many factors, including the timing of regulatory approvals and the occurrence of

storms and other events causing outages or damages to the Utility’s infrastructure. Cash used in investing activities

also includes the proceeds from sales of nuclear decommissioning trust investments which are largely offset by the

amount of cash used to purchase new nuclear decommissioning trust investments. The funds in the decommissioning

trusts, along with accumulated earnings, are used exclusively for decommissioning and dismantling the Utility’s

nuclear facilities.

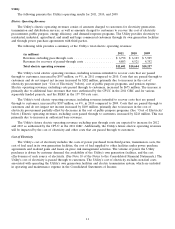

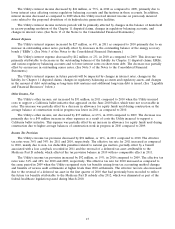

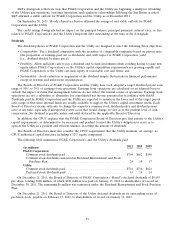

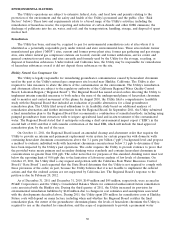

The Utility’s cash flows from investing activities for 2011, 2010, and 2009 were as follows:

2011 2010 2009

(in millions)

Capital expenditures ................................................. $(4,038) $(3,802) $(3,958)

Decrease in restricted cash ............................................. 200 66 666

Proceeds from sales and maturities of nuclear decommissioning trust investments ..... 1,928 1,405 1,351

Purchases of nuclear decommissioning trust investments ....................... (1,963) (1,456) (1,414)

Other ............................................................ 14 19 11

Net cash used in investing activities ...................................... $(3,859) $(3,768) $(3,344)

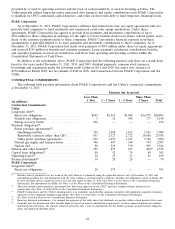

Net cash used in investing activities increased by $91 million in 2011 compared to 2010. This increase was

primarily due to an increase of $236 million in capital expenditures. This increase was partially offset by a decrease

of $134 million in restricted cash that was primarily due to releases from escrow for settled or withdrawn Chapter 11

disputed claims in 2011, with few similar releases in 2010.

Net cash used in investing activities increased by $424 million in 2010 compared to 2009, primarily due to the

Utility’s $700 million payment to the PX which decreased the restricted cash balance in 2009. This increase was

partially offset by a decrease in capital expenditures of $156 million as compared to 2009. Capital expenditures

decreased in 2010 due to permitting delays, the postponement of purchases of materials which would otherwise have

been capitalized earlier in the year, and poor weather conditions in the first half of 2010 which delayed construction

activities as resources were re-directed to emergency response activities.

Future cash flows used in investing activities are largely dependent on the timing and amount of capital

expenditures. (See ‘‘Capital Expenditures’’ below for further discussion of expected spending and significant capital

projects.)

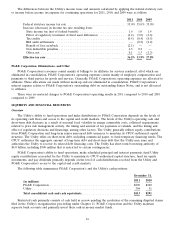

Financing Activities

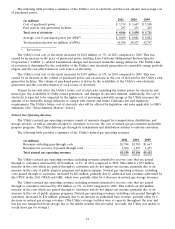

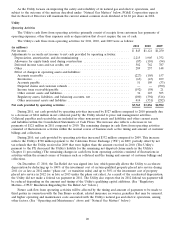

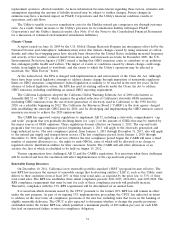

The Utility’s cash flows from financing activities for 2011, 2010, and 2009 were as follows:

2011 2010 2009

(in millions)

Borrowings under revolving credit facilities ................................... $208 $ 400 $ 300

Repayments under revolving credit facilities ................................... (208) (400) (300)

Net issuances of commercial paper, net of discount of $4 in 2011 and $3 in 2010 and 2009 . 782 267 43

Proceeds from issuance of short-term debt, net of issuance costs of $1 in 2010 and 2009 . . . 250 249 499

Proceeds from issuance of long-term debt, net of premium, discount, and issuance costs of

$8 in 2011, $23 in 2010, and $25 in 2009 ................................... 792 1,327 1,384

Short-term debt matured ................................................ (250) (500) —

Long-term debt matured or repurchased ..................................... (700) (95) (909)

Energy recovery bonds matured ........................................... (404) (386) (370)

Preferred stock dividends paid ............................................. (14) (14) (14)

Common stock dividends paid ............................................. (716) (716) (624)

Equity contribution ..................................................... 555 190 718

Other .............................................................. 54 (73) (5)

Net cash provided by financing activities ..................................... $ 349 $ 249 $ 722

In 2011, net cash provided by financing activities increased by $100 million compared to the same period in

2010. In 2010, net cash provided by financing activities decreased by $473 million compared to 2009. Cash provided

by or used in financing activities is driven by the Utility’s financing needs, which depend on the level of cash

21