PG&E 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

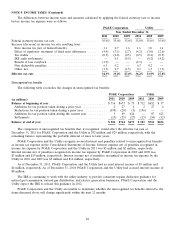

NOTE 6: COMMON STOCK AND SHARE-BASED COMPENSATION (Continued)

PG&E Corporation and the Utility each have revolving credit facilities that require the respective company to

maintain a ratio of consolidated total debt to consolidated capitalization of at most 65%. Based on the calculation of

this ratio for PG&E Corporation, no amount of PG&E Corporation’s reinvested earnings were restricted at

December 31, 2011. Based on the calculation of this ratio for the Utility, $2.3 billion of the Utility’s reinvested

earnings were restricted at December 31, 2011. In addition, the CPUC requires the Utility to maintain a capital

structure composed of at least 52% equity on average. At December 31, 2011, the Utility was required to maintain

reinvested earnings of $6.7 billion as equity to meet this requirement.

In addition, to comply with the revolving credit facility’s 65% ratio requirement and the CPUC’s requirement to

maintain a 52% equity component, $7.2 billion and $11.7 billion of the Utility’s net assets, respectively, were

restricted at December 31, 2011 and could not be transferred to PG&E Corporation in the form of cash dividends.

As a holding company, PG&E Corporation depends on cash distributions from the Utility to meet its debt service

and other financial obligations and to pay dividends on its common stock.

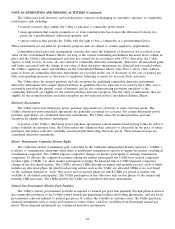

Long-Term Incentive Plan

The PG&E Corporation 2006 Long-Term Incentive Plan (‘‘2006 LTIP’’) permits the award of various forms of

incentive awards, including stock options, stock appreciation rights, restricted stock awards, restricted stock units

(‘‘RSU’’), performance shares, deferred compensation awards, and other share-based awards, to eligible employees of

PG&E Corporation and its subsidiaries. Non-employee directors of PG&E Corporation are also eligible to receive

restricted stock and either stock options or RSUs under the formula grant provisions of the 2006 LTIP. A maximum

of 12 million shares of PG&E Corporation common stock (subject to adjustment for changes in capital structure,

stock dividends, or other similar events) has been reserved for issuance under the 2006 LTIP, of which 5,715,712

shares were available for award at December 31, 2011.

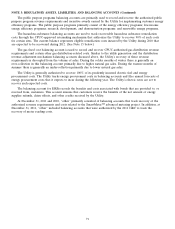

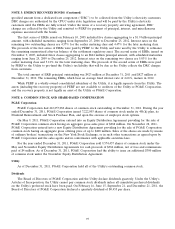

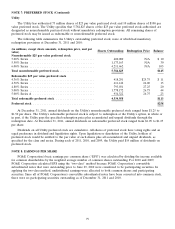

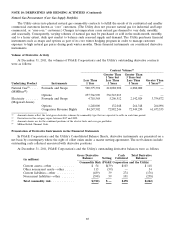

The following table provides a summary of total compensation expense for PG&E Corporation for share-based

incentive awards for 2011, 2010, and 2009:

2011 2010 2009

(in millions)

Restricted stock units .............. $ 22 $ 9 $ 11

Restricted stock .................. 1 14 9

Performance shares:

Liability awards ................ (13) 22 37

Equity awards ................. 16 11 —

Total compensation expense (pre-tax) .. $ 26 $ 56 $ 57

Total compensation expense (after-tax) .$ 16 $ 33 $ 34

There were no significant share-based compensation costs capitalized during 2011, 2010, and 2009. There was no

material difference between PG&E Corporation and the Utility for the information disclosed above.

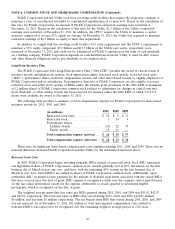

Restricted Stock Units

In 2009, PG&E Corporation began awarding primarily RSUs instead of restricted stock. Each RSU represents

one hypothetical share of PG&E Corporation common stock. Awards generally vest in 20% increments on the first

business day of March in year one, two, and three, with the remaining 40% vesting on the first business day of

March in year four. Vested RSUs are settled in shares of PG&E Corporation common stock. Additionally, upon

settlement, RSU recipients receive payment for the amount of dividend equivalents associated with the vested RSUs

that have accrued since the date of grant. RSU expense is recognized ratably over the requisite service period based

on the fair values determined, except for the expense attributable to awards granted to retirement-eligible

participants, which is recognized on the date of grant.

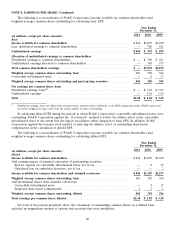

The weighted average grant-date fair value per RSUs granted during 2011, 2010, and 2009 was $45.10, $42.97,

and $35.53, respectively. The total fair value of RSUs that vested during 2011, 2010, and 2009 was $11 million,

$5 million, and less than $1 million, respectively. The tax benefit from RSU that vested during 2011, 2010, and 2009

was not material. As of December 31, 2011, $31 million of total unrecognized compensation costs related to

nonvested RSUs was expected to be recognized over the remaining weighted average period of 2.42 years.

76