PG&E 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

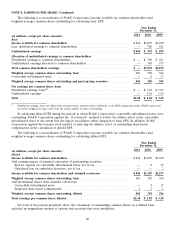

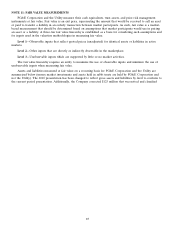

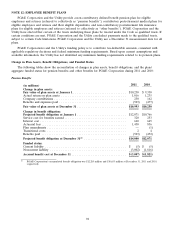

NOTE 9: INCOME TAXES (Continued)

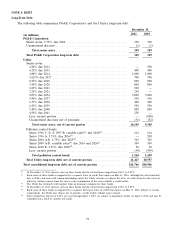

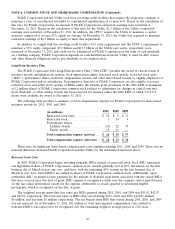

The differences between income taxes and amounts calculated by applying the federal statutory rate to income

before income tax expense were as follows:

PG&E Corporation Utility

Year Ended December 31,

2011 2010 2009 2011 2010 2009

Federal statutory income tax rate ........................ 35.0% 35.0% 35.0% 35.0% 35.0% 35.0%

Increase (decrease) in income tax rate resulting from:

State income tax (net of federal benefit) ................. 1.1 0.7 1.6 1.6 1.0 1.4

Effect of regulatory treatment of fixed asset differences ...... (4.4) (3.1) (2.7) (4.2) (3.0) (2.6)

Tax credits ...................................... (0.5) (0.4) (0.5) (0.5) (0.4) (0.5)

IRS audit settlements .............................. —0.1 (4.5) —(0.2) (4.2)

Benefit of loss carryback ............................ (1.9) ——(2.1) ——

Non deductible penalties ............................ 6.5 0.2 — 6.3 0.2 —

Other, net ....................................... (1.5) 0.7 (1.5) 0.1 1.3 (1.3)

Effective tax rate ................................... 34.3% 33.2% 27.4% 36.2% 33.9% 27.8%

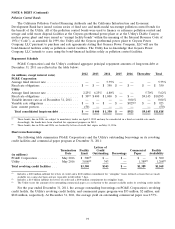

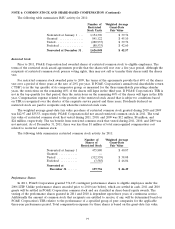

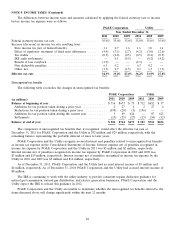

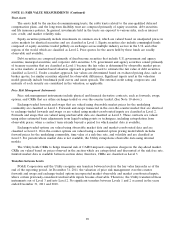

Unrecognized tax benefits

The following table reconciles the changes in unrecognized tax benefits:

PG&E Corporation Utility

2011 2010 2009 2011 2010 2009

(in millions)

Balance at beginning of year ................................ $714 $673 $ 75 $ 712 $652 $ 37

Additions for tax position taken during a prior year ............. 2 27 4 2 27 4

Reductions for tax position taken during a prior year ............ (198) (20) (3) (196) ——

Additions for tax position taken during the current year .......... 3 89 624 — 87 623

Settlements .......................................... (15) (55) (27) (15) (54) (12)

Balance at end of year .................................... $ 506 $714 $673 $ 503 $712 $652

The component of unrecognized tax benefits that, if recognized, would affect the effective tax rate at

December 31, 2011 for PG&E Corporation and the Utility is $32 million and $29 million, respectively, with the

remaining balance representing the probable deferral of taxes to later years.

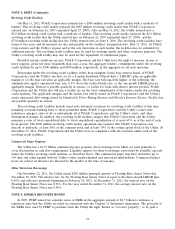

PG&E Corporation and the Utility recognize accrued interest and penalties related to unrecognized tax benefits

as income tax expense in the Consolidated Statements of Income. Interest expense net of penalties recognized in

income tax expense by PG&E Corporation and the Utility in 2011 was $3 million and $2 million, respectively.

Interest income net of penalties recognized in income tax expense by PG&E Corporation in 2010 and 2009 was

$3 million and $19 million, respectively. Interest income net of penalties recognized in income tax expense by the

Utility in 2010 and 2009 was $3 million and $14 million, respectively.

As of December 31, 2011, PG&E Corporation and the Utility had accrued interest income of $3 million and

$4 million, respectively. As of December 31, 2010, PG&E Corporation and the Utility had accrued interest income of

$8 million.

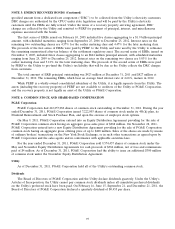

The IRS is continuing to work with the utility industry to provide consistent repairs deduction guidance for

natural gas transmission, natural gas distribution, and electric generation businesses. PG&E Corporation and the

Utility expect the IRS to release this guidance in 2012.

PG&E Corporation and the Utility are unable to determine whether the unrecognized tax benefits related to the

items discussed above will change significantly within the next 12 months.

82