PG&E 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 15: COMMITMENTS AND CONTINGENCIES (Continued)

agreements are contingent on the third parties’ development of new generation facilities to provide the power to be

purchased by the Utility under the agreements. The Utility also has agreements with various irrigation districts and

water agencies to purchase hydroelectric power that require the Utility to make semi-annual fixed minimum

payments. In addition, these agreements require the Utility to make variable payments based on the operating and

maintenance costs incurred by the irrigation districts and water agencies.

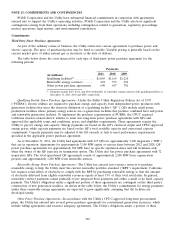

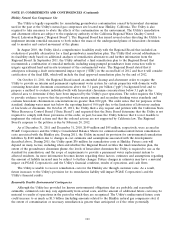

At December 31, 2011, the undiscounted future expected payment obligations under power purchase agreements

that have been approved by the CPUC and have completed major milestones for construction were as follows:

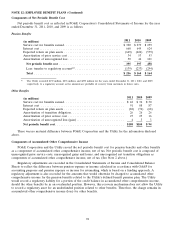

Qualifying Renewable Total

Facility (Other than QF) Other Payments

(in millions)

2012 ............ $ 736 $ 831 $ 656 $ 2,223

2013 ............ 781 1,058 807 2,646

2014 ............ 807 1,269 646 2,722

2015 ............ 725 1,352 614 2,691

2016 ............ 690 1,370 601 2,661

Thereafter ....... 3,341 18,058 3,726 25,125

Total ........... $7,080 $23,938 $7,050 $38,068

The table above excludes $34 billion of future expected payments that were previously included in prior periods

related to agreements ranging from 10 to 25 years in length that are cancellable if the construction of a new

generation facility have not met certain contractual milestones with respect to construction. Based on the Utility’s

experience with these types of facilities, the Utility has determined that there is more than a remote chance that

contracts could be cancelled until the generation facilities have commenced construction.

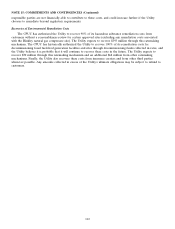

Some of the power purchase agreements that the Utility entered into with independent power producers that are

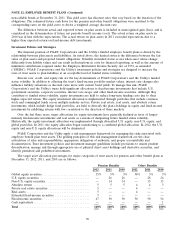

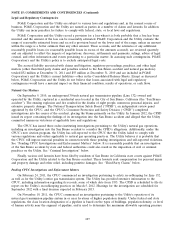

QFs are treated as capital leases. The following table shows the future fixed capacity payments due under the QF

contracts that are treated as capital leases. (These amounts are also included in the table above.) The fixed capacity

payments are discounted to their present value in the table below using the Utility’s incremental borrowing rate at

the inception of the leases. The amount of this discount is shown in the table below as the amount representing

interest.

(in millions)

2012 .................................................. $ 50

2013 .................................................. 50

2014 .................................................. 42

2015 .................................................. 38

2016 .................................................. 36

Thereafter .............................................. 89

Total fixed capacity payments ................................ 305

Less: amount representing interest ............................. 57

Present value of fixed capacity payments ........................ $248

Minimum lease payments associated with the lease obligations are included in cost of electricity on PG&E

Corporation’s and the Utility’s Consolidated Statements of Income. The timing of the recognition of the lease

expense conforms to the ratemaking treatment for the Utility’s recovery of the cost of electricity. The QF contracts

that are treated as capital leases expire between April 2014 and September 2021.

The present value of the fixed capacity payments due under these contracts is recorded on PG&E Corporation’s

and the Utility’s Consolidated Balance Sheets. At December 31, 2011 and 2010, current liabilities—other included

$36 million and $34 million, respectively, and noncurrent liabilities—other included $212 million and $248 million,

respectively. The corresponding assets at December 31, 2011 and 2010 of $248 million and $282 million including

accumulated amortization of $160 million and $126 million, respectively are included in property, plant, and

equipment on PG&E Corporation’s and the Utility’s Consolidated Balance Sheets.

103