PG&E 2011 Annual Report Download - page 79

Download and view the complete annual report

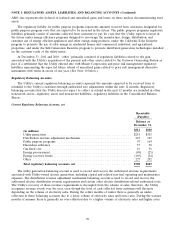

Please find page 79 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 5: ENERGY RECOVERY BONDS (Continued)

specified amount from a dedicated rate component (‘‘DRC’’) to be collected from the Utility’s electricity customers.

DRC charges are authorized by the CPUC under state legislation and will be paid by the Utility’s electricity

customers until the ERBs are fully retired. Under the terms of a recovery property servicing agreement, DRC

charges are collected by the Utility and remitted to PERF for payment of principal, interest, and miscellaneous

expenses associated with the bonds.

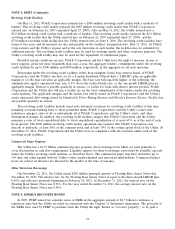

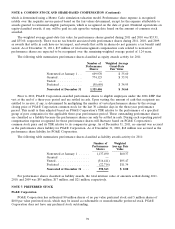

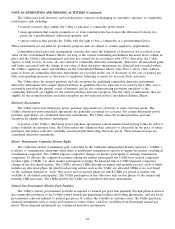

The first series of ERBs issued on February 10, 2005 included five classes aggregating to a $1.9 billion principal

amount, with scheduled maturities ranging from September 25, 2006 to December 25, 2012. Interest rates on the

remaining two outstanding classes are 4.37% for the earlier maturing class and 4.47% for the later maturing class.

The proceeds of the first series of ERBs were paid by PERF to the Utility and were used by the Utility to refinance

the remaining unamortized after-tax balance of the settlement regulatory asset. The second series of ERBs, issued on

November 9, 2005, included three classes aggregating to an $844 million principal amount, with scheduled maturities

ranging from June 25, 2009 to December 25, 2012. Interest rates on the remaining two classes are 5.03% for the

earlier maturing class and 5.12% for the later maturing class. The proceeds of the second series of ERBs were paid

by PERF to the Utility to pre-fund the Utility’s tax liability that will be due as the Utility collects the DRC charges

from customers.

The total amount of ERB principal outstanding was $423 million at December 31, 2011 and $827 million at

December 31, 2010. The remaining ERBs, which bear an average fixed interest rate of 4.66%, mature in 2012.

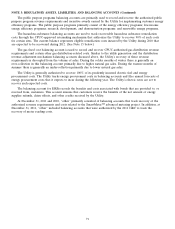

While PERF is a wholly owned consolidated subsidiary of the Utility, it is legally separate from the Utility. The

assets (including the recovery property) of PERF are not available to creditors of the Utility or PG&E Corporation,

and the recovery property is not legally an asset of the Utility or PG&E Corporation.

NOTE 6: COMMON STOCK AND SHARE-BASED COMPENSATION

PG&E Corporation

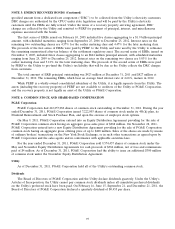

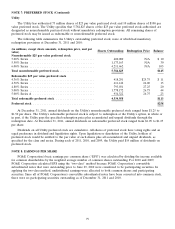

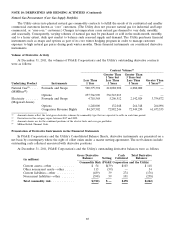

PG&E Corporation had 412,257,082 shares of common stock outstanding at December 31, 2011. During the year

ended December 31, 2011, PG&E Corporation issued 7,222,803 shares of common stock under its 401(k) plan, its

Dividend Reinvestment and Stock Purchase Plan, and upon the exercise of employee stock options.

On May 9, 2011, PG&E Corporation entered into an Equity Distribution Agreement providing for the sale of

PG&E Corporation common stock having an aggregate gross sales price of $288 million. On November 28, 2011,

PG&E Corporation entered into a new Equity Distribution Agreement providing for the sale of PG&E Corporation

common stock having an aggregate gross offering price of up to $400 million. Sales of the shares are made by means

of ordinary brokers’ transactions on the New York Stock Exchange, or in such other transactions as agreed upon by

PG&E Corporation and the sales agents and in conformance with applicable securities laws.

For the year ended December 31, 2011, PG&E Corporation sold 9,574,457 shares of common stock under the

May and November Equity Distribution Agreements for cash proceeds of $384 million, net of fees and commissions

paid of $4 million. As of December 31, 2011, PG&E Corporation had the ability to issue an additional $300 million

of common stock under the November Equity Distribution Agreement.

Utility

As of December 31, 2011, PG&E Corporation held all of the Utility’s outstanding common stock.

Dividends

The Board of Directors of PG&E Corporation and the Utility declare dividends quarterly. Under the Utility’s

Articles of Incorporation, the Utility cannot pay common stock dividends unless all cumulative preferred dividends

on the Utility’s preferred stock have been paid. On February 16, June 15, September 21, and December 21, 2011, the

Board of Directors of PG&E Corporation declared a quarterly dividend of $0.455 per share.

75