PG&E 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

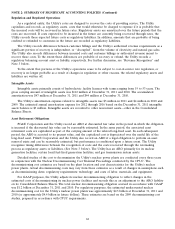

Regulation and Regulated Operations

As a regulated entity, the Utility’s rates are designed to recover the costs of providing service. The Utility

capitalizes and records, as regulatory assets, costs that would otherwise be charged to expense if it is probable that

the incurred costs will be recovered in future rates. Regulatory assets are amortized over the future periods that the

costs are recovered. If costs expected to be incurred in the future are currently being recovered through rates, the

Utility records those expected future costs as regulatory liabilities. In addition, amounts that are probable of being

credited or refunded to customers in the future are recorded as regulatory liabilities.

The Utility records differences between customer billings and the Utility’s authorized revenue requirements as a

significant portion of recovery is independent, or ‘‘decoupled’’, from the volume of electricity and natural gas sales.

The Utility also records differences between incurred costs and customer billings or authorized revenue meant to

recover those costs. To the extent these differences are probable of recovery or refund, the Utility records a

regulatory balancing account asset or liability, respectively. For further discussion, see ‘‘Revenue Recognition’’ and

Note 3 below.

To the extent that portions of the Utility’s operations cease to be subject to cost-of-service rate regulation, or

recovery is no longer probable as a result of changes in regulation or other reasons, the related regulatory assets and

liabilities are written off.

Intangible Assets

Intangible assets primarily consist of hydroelectric facility licenses with terms ranging from 19 to 53 years. The

gross carrying amount of intangible assets was $112 million at December 31, 2011 and 2010. The accumulated

amortization was $47 million at December 31, 2011 and $44 million at December 31, 2010.

The Utility’s amortization expense related to intangible assets was $3 million in 2011 and $4 million in 2010 and

2009. The estimated annual amortization expense for 2012 through 2016 based on the December 31, 2011 intangible

assets balance is $3 million. Intangible assets are recorded to other noncurrent assets—other in the Consolidated

Balance Sheets.

Asset Retirement Obligations

PG&E Corporation and the Utility record an ARO at discounted fair value in the period in which the obligation

is incurred if the discounted fair value can be reasonably estimated. In the same period, the associated asset

retirement costs are capitalized as part of the carrying amount of the related long-lived asset. In each subsequent

period, the ARO is accreted to its present value, and the capitalized cost is depreciated over the useful life of the

long-lived asset. PG&E Corporation and the Utility also record an ARO if a legal obligation to perform an asset

removal exists and can be reasonably estimated, but performance is conditional upon a future event. The Utility

recognizes timing differences between the recognition of costs and the costs recovered through the ratemaking

process as regulatory assets or liabilities. (See Note 3 below). The Utility has an ARO primarily for its nuclear

generation facilities, certain fossil fuel-fired generation facilities, and gas transmission system assets.

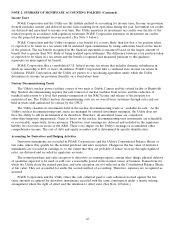

Detailed studies of the cost to decommission the Utility’s nuclear power plants are conducted every three years

in conjunction with the Nuclear Decommissioning Cost Triennial Proceedings conducted by the CPUC. The

decommissioning cost estimates are based on the plant location and cost characteristics for the Utility’s nuclear

power plants. Actual decommissioning costs may vary from these estimates as a result of changes in assumptions such

as decommissioning dates; regulatory requirements; technology; and costs of labor, materials, and equipment.

For GAAP purposes, the Utility adjusts its nuclear decommissioning obligation to reflect changes in the

estimated costs of decommissioning its nuclear power facilities and records this as an adjustment to the ARO liability

on its Consolidated Balance Sheets. The total nuclear decommissioning obligation accrued in accordance with GAAP

was $1.2 billion at December 31, 2011 and 2010. For regulatory purposes, the estimated undiscounted nuclear

decommissioning cost for the Utility’s nuclear power plants was approximately $2.3 billion at December 31, 2011 and

2010 (or approximately $4.4 billion in future dollars). These estimates are based on the 2009 decommissioning cost

studies, prepared in accordance with CPUC requirements.

62