PG&E 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

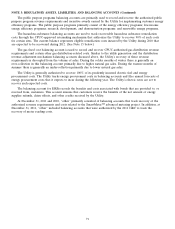

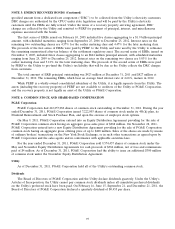

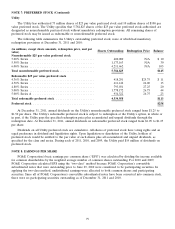

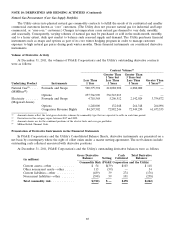

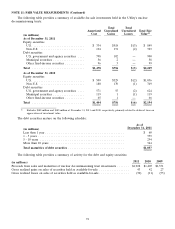

NOTE 9: INCOME TAXES

The significant components of income tax provision (benefit) were as follows:

PG&E Corporation Utility

Year Ended December 31,

2011 2010 2009 2011 2010 2009

(in millions)

Current:

Federal ........................................... $ (77) $(12) $(747) $ (83) $(54) $ (696)

State ............................................. 152 130 (41) 161 134 (45)

Deferred:

Federal ........................................... 504 525 1,161 534 589 1,139

State ............................................. (135) (91) 92 (128) (90) 89

Tax credits .......................................... (4) (5) (5) (4) (5) (5)

Income tax provision ................................. $ 440 $547 $ 460 $ 480 $574 $ 482

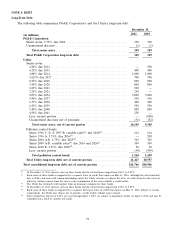

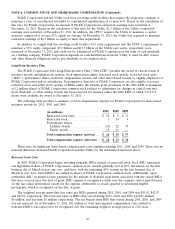

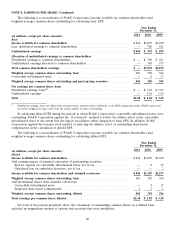

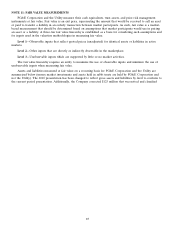

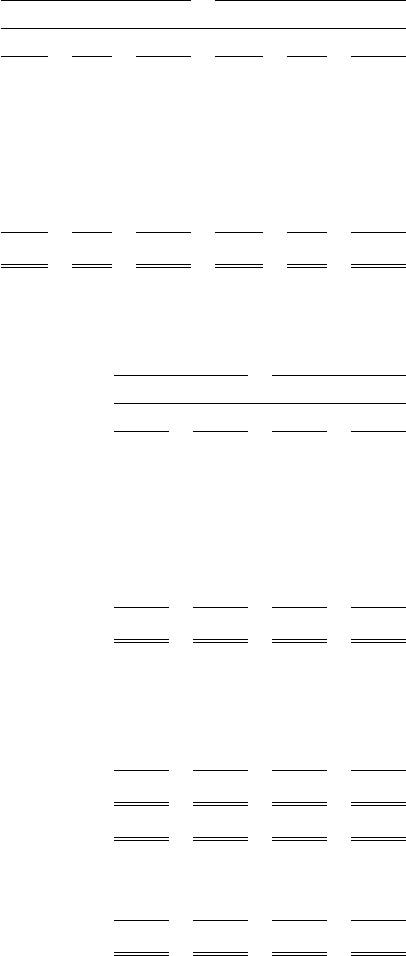

The following describes net deferred income tax liabilities:

PG&E

Corporation Utility

Year Ended December 31,

2011 2010 2011 2010

(in millions)

Deferred income tax assets:

Customer advances for construction ................................. $ 108 $ — $ 108 $ —

Reserve for damages ............................................ 243 222 243 222

Environmental reserve ........................................... 157 242 157 242

Compensation ................................................. 310 345 258 305

Net operating loss carry forward .................................... 728 327 567 270

Other ....................................................... 217 207 180 178

Total deferred income tax assets .................................. $1,763 $1,343 $1,513 $1,217

Deferred income tax liabilities:

Regulatory balancing accounts ..................................... $ 878 $1,116 $ 878 $1,116

Property related basis differences ................................... 6,309 5,236 6,301 5,234

Income tax regulatory asset ....................................... 588 509 588 509

Other ....................................................... 192 142 105 135

Total deferred income tax liabilities ................................ $7,967 $7,003 $7,872 $6,994

Total net deferred income tax liabilities ............................. $6,204 $5,660 $6,359 $5,777

Classification of net deferred income tax liabilities:

Included in current liabilities ...................................... $ 196 $ 113 $ 199 $ 118

Included in noncurrent liabilities .................................... 6,008 5,547 6,160 5,659

Total net deferred income tax liabilities ............................. $6,204 $5,660 $6,359 $5,777

81