PG&E 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compressor station located in Hinkley, California, penalties associated with investigations or violations, or that the

Utility has decided it will not seek to recover through rates, such as certain costs associated with its natural gas

transmission pipeline operations.

This is a combined annual report of PG&E Corporation and the Utility, and includes separate Consolidated

Financial Statements for each of these two entities. PG&E Corporation’s Consolidated Financial Statements include

the accounts of PG&E Corporation, the Utility, and other wholly owned and controlled subsidiaries. The Utility’s

Consolidated Financial Statements include the accounts of the Utility and its wholly owned and controlled

subsidiaries. This combined Management’s Discussion and Analysis of Financial Condition and Results of Operations

(‘‘MD&A’’) of PG&E Corporation and the Utility should be read in conjunction with the Consolidated Financial

Statements and the Notes to the Consolidated Financial Statements included in this annual report.

Key Factors Affecting Results of Operations and Financial Condition

During 2011, PG&E Corporation’s and the Utility’s financial condition, results of operations, and cash flows,

continued to be negatively affected by proceedings and investigations related to its natural gas pipeline operations

that were commenced after the rupture of one of the Utility’s natural gas transmission pipelines in San Bruno,

California on September 9, 2010 (the ‘‘San Bruno accident’’). On August 30, 2011, the National Transportation Safety

Board (‘‘NTSB’’) announced that it had determined the probable cause of the San Bruno accident placing the blame

primarily on the Utility. Most recently, on January 12, 2012, the CPUC opened an investigation to determine

whether the Utility violated applicable laws and regulations in connection with the San Bruno accident, citing the

findings and allegations made by the CPUC’s Consumer Protection and Safety Division (‘‘CPSD’’) in its investigative

report released on January 12, 2012. The CPUC is conducting two other investigations and a rulemaking proceeding

regarding natural gas matters. The Utility has also self-reported to the CPUC violations of various regulations and

orders applicable to natural gas operating practices. (See ‘‘Natural Gas Matters’’ below.) The outcome of these

matters and a number of other factors have had, and will continue to have, a material impact on PG&E

Corporation’s and the Utility’s future results of operations, financial condition, and cash flows as discussed below.

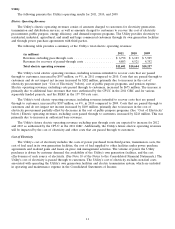

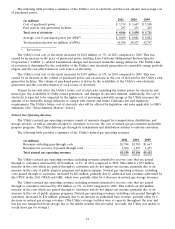

•The Outcome of Matters Related to the Utility’s Natural Gas System. In 2011, the Utility incurred expenses of

$483 million for hydrostatic pressure tests and other pipeline-related activities that will not be recovered

through rates. In 2012, the Utility forecasts that it will incur costs associated with its natural gas pipeline

system ranging from $450 million to $550 million that may not be recoverable through rates. Although the

Utility has requested the CPUC to authorize the Utility to recover certain costs it incurs in 2012 and future

years under its proposed pipeline safety enhancement plan, it is uncertain what portion of these costs will be

recoverable and when such costs will be recovered. (See ‘‘Natural Gas Matters—CPUC Rulemaking

Proceeding’’ below.) Additionally, the Utility has incurred a cumulative charge of $375 million ($155 million in

2011 and $220 million in 2010) for third-party claims related to the San Bruno accident and estimates that it

is reasonably possible it will incur up to an additional $225 million, for a total possible loss of $600 million.

PG&E Corporation and the Utility also believe that it is probable the CPUC will impose penalties of at least

$200 million on the Utility as a result of its pending investigations and the Utility’s self-reported violations and

have accrued this amount as of December 31, 2011. PG&E Corporation and the Utility are unable to estimate

the reasonably possible amount of penalties in excess of the amount accrued, and such amounts could be

material. (See Note 15 of the Notes to the Consolidated Financial Statements.) An investigation of the San

Bruno accident by federal and state authorities also may result in the imposition of civil or criminal penalties

on the Utility. PG&E Corporation’s and the Utility’s future financial condition, results of operations, and cash

flows will be affected by the scope and timing of the final CPUC-approved pipeline safety enhancement plan,

the ultimate amount of pipeline-related costs that are not recovered through rates, the ultimate amount of

costs incurred for third-party claims that are not recoverable through insurance, and the ultimate amount of

civil or criminal penalties, or punitive damages the Utility may be required to pay.

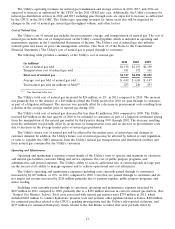

•The Ability of the Utility to Control Operating Costs and Capital Expenditures. The Utility’s revenue

requirements are generally set by the CPUC and the FERC at a level to allow the Utility to recover its

forecasted operating expenses, to recover depreciation, tax, and interest expenses associated with forecasted

capital expenditures, and to earn a ROE. Actual costs may differ from the Utility’s forecasts, or the Utility

may incur significant unanticipated costs. For example, in addition to the expenses related to natural gas

matters above, the Utility forecasts that it will incur expenses in each of 2012 and 2013 that are approximately

$200 million higher than amounts assumed under the 2011 GRC and the GT&S rate case as the Utility works

to improve the safety and reliability of its electric and natural gas operations. This higher level of expenditures

will negatively affect PG&E Corporation’s and the Utility’s future financial condition, results of operations,

5