PG&E 2011 Annual Report Download - page 27

Download and view the complete annual report

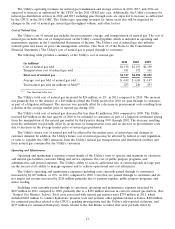

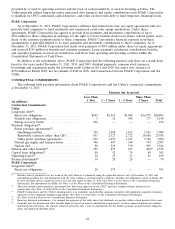

Please find page 27 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The contractual commitments table above excludes potential commitments associated with the conversion of

existing overhead electric facilities to underground electric facilities. At December 31, 2011, the Utility was

committed to spending approximately $292 million for these conversions. These funds are conditionally committed

depending on the timing of the work, including the schedules of the respective cities, counties, and communication

utilities involved. The Utility expects to spend approximately $61 million to $86 million each year in connection with

these projects. Consistent with past practice, the Utility expects that these capital expenditures will be included in

rate base as each individual project is completed and recoverable in rates charged to customers.

The contractual commitments table above also excludes potential payments associated with unrecognized tax

benefits. Due to the uncertainty surrounding tax audits, PG&E Corporation and the Utility cannot make reliable

estimates of the amount and period of future payments to major tax jurisdictions related to unrecognized tax

benefits. Matters relating to tax years that remain subject to examination are discussed in Note 9 of the Notes to the

Consolidated Financial Statements.

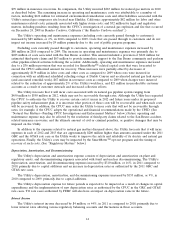

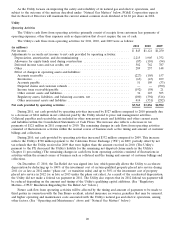

CAPITAL EXPENDITURES

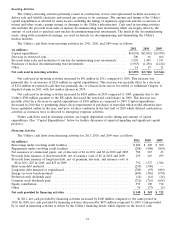

The Utility makes various capital investments in its electric generation and electric and natural gas transmission

and distribution infrastructure to maintain and improve system reliability, safety, and customer service; to extend the

life of or replace existing infrastructure; and to add new infrastructure to meet growth. Most of the Utility’s revenue

requirements to recover forecasted capital expenditures are authorized in the GRC, TO, and GT&S rate cases. The

Utility also collects additional revenue requirements to recover capital expenditures related to projects that have

been specifically authorized by the CPUC, such as new power plants, gas or electric distribution projects, and the

SmartMeterTM advanced metering infrastructure.

The Utility’s capital expenditures for property, plant, and equipment totaled $4.2 billion in 2011, $3.9 billion in

2010, and $3.9 billion in 2009. The amount of capital expenditures differs from the amount of rate base additions

used for regulatory purposes primarily because authorized capital expenditures are not added to rate base until the

assets are placed in service.

The Utility’s ability to invest in its electric and natural gas systems and develop new generation facilities is

subject to many risks, including risks related to securing adequate and reasonably priced financing, obtaining and

complying with terms of permits, meeting construction budgets and schedules, and satisfying operating and

environmental performance standards. (See ‘‘Risk Factors’’ below.)

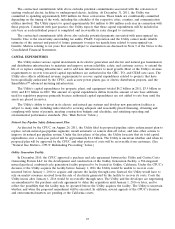

Natural Gas Pipeline Safety Enhancement Plan

As directed by the CPUC, on August 26, 2011, the Utility filed its proposed pipeline safety enhancement plan to

replace certain natural gas pipeline segments, install automatic or remote shut-off valves, and take other actions to

improve its natural gas pipeline system. Under the first phase of the plan, the Utility forecasts that its total capital

expenditures over a four-year period will be approximately $1.4 billion. The Utility is uncertain whether and when its

proposed plan will be approved by the CPUC and what portion of costs will be recoverable from customers. (See

‘‘Natural Gas Matters—CPUC Rulemaking Proceeding’’ below.)

Oakley Generation Facility

In December 2010, the CPUC approved a purchase and sale agreement between the Utility and Contra Costa

Generating Station LLC for the development and construction of the Oakley Generation Facility, a 586-megawatt

natural gas-fired, combined-cycle generation facility proposed to be located in Oakley, California. Under the CPUC’s

decision, if the Utility acquires the facility before January 1, 2016 the Utility would be unable to recover costs

incurred before January 1, 2016 to acquire and operate the facility through rates. Instead, the Utility would have to

rely on market revenues received from the sale of electricity generated by the facility to recover its costs. Costs the

Utility incurs after January 1, 2016 would be recoverable through rates. The Utility and the developer are negotiating

an amendment to the purchase and sale agreement to delay the acquisition until January 1, 2016 or later, and to

reflect the possibility that the facility may be operated before the Utility acquires the facility. The Utility is uncertain

whether and when the proposed amendment will be executed. In addition, several appeals of the CPUC’s decision

and environmental matters are pending at the California courts.

23