PG&E 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

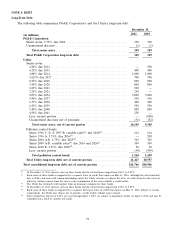

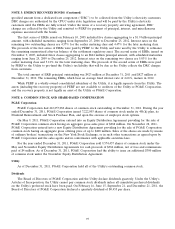

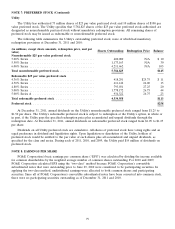

NOTE 7: PREFERRED STOCK (Continued)

Utility

The Utility has authorized 75 million shares of $25 par value preferred stock and 10 million shares of $100 par

value preferred stock. The Utility specifies that 5,784,825 shares of the $25 par value preferred stock authorized are

designated as nonredeemable preferred stock without mandatory redemption provisions. All remaining shares of

preferred stock may be issued as redeemable or nonredeemable preferred stock.

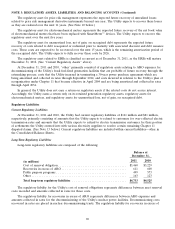

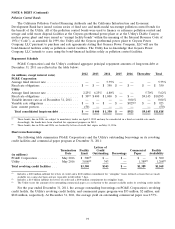

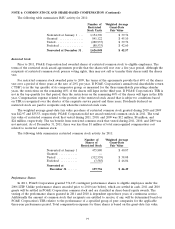

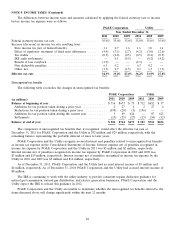

The following table summarizes the Utility’s outstanding preferred stock, none of which had mandatory

redemption provisions at December 31, 2011 and 2010:

(in millions, except share amounts, redemption price, and par Shares Outstanding Redemption Price Balance

value)

Nonredeemable $25 par value preferred stock

5.00% Series ..................................... 400,000 N/A $ 10

5.50% Series ..................................... 1,173,163 N/A 30

6.00% Series ..................................... 4,211,662 N/A 105

Total nonredeemable preferred stock .................... 5,784,825 $145

Redeemable $25 par value preferred stock

4.36% Series ..................................... 418,291 $25.75 $ 11

4.50% Series ..................................... 611,142 26.00 15

4.80% Series ..................................... 793,031 27.25 20

5.00% Series ..................................... 1,778,172 26.75 44

5.00% Series A ................................... 934,322 26.75 23

Total redeemable preferred stock ...................... 4,534,958 $113

Preferred stock ................................... $258

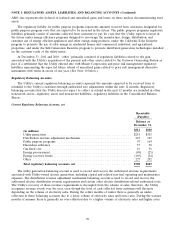

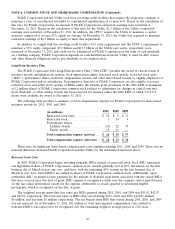

At December 31, 2011, annual dividends on the Utility’s nonredeemable preferred stock ranged from $1.25 to

$1.50 per share. The Utility’s redeemable preferred stock is subject to redemption at the Utility’s option, in whole or

in part, if the Utility pays the specified redemption price plus accumulated and unpaid dividends through the

redemption date. At December 31, 2011, annual dividends on redeemable preferred stock ranged from $1.09 to $1.25

per share.

Dividends on all Utility preferred stock are cumulative. All shares of preferred stock have voting rights and an

equal preference in dividend and liquidation rights. Upon liquidation or dissolution of the Utility, holders of

preferred stock would be entitled to the par value of such shares plus all accumulated and unpaid dividends, as

specified for the class and series. During each of 2011, 2010, and 2009, the Utility paid $14 million of dividends on

preferred stock.

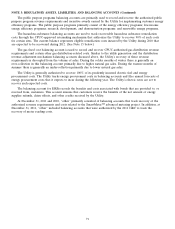

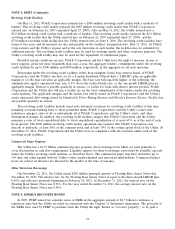

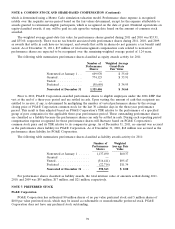

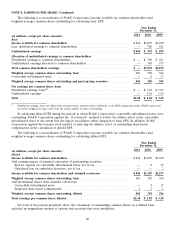

NOTE 8: EARNINGS PER SHARE

PG&E Corporation’s basic earnings per common share (‘‘EPS’’) was calculated by dividing the income available

for common shareholders by the weighted average number of common shares outstanding. For 2010 and 2009,

PG&E Corporation calculated EPS using the ‘‘two-class’’ method because PG&E Corporation’s convertible

subordinated notes that were outstanding prior to June 29, 2010 were considered to be participating securities. In

applying the two-class method, undistributed earnings were allocated to both common shares and participating

securities. Since all of PG&E Corporation’s convertible subordinated notes have been converted into common stock,

there were no participating securities outstanding as of December 31, 2011 and 2010.

79