PG&E 2011 Annual Report Download - page 78

Download and view the complete annual report

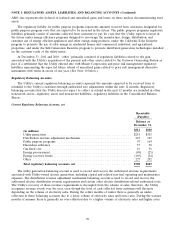

Please find page 78 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 4: DEBT (Continued)

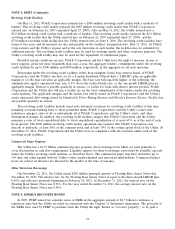

Revolving Credit Facilities

On May 31, 2011, PG&E Corporation entered into a $300 million revolving credit facility with a syndicate of

lenders. This revolving credit facility replaced the $187 million revolving credit facility that PG&E Corporation

entered into on February 26, 2007 (amended April 27, 2009). Also on May 31, 2011, the Utility entered into a

$3.0 billion revolving credit facility with a syndicate of lenders. This revolving credit facility replaced the $1.9 billion

revolving credit facility that the Utility entered into on February 26, 2007 (amended April 27, 2009), and the

$750 million revolving credit facility that the Utility entered into on June 8, 2010. The revolving credit facilities have

terms of five years and all amounts are due and payable on the facilities’ termination date, May 31, 2016. At PG&E

Corporation’s and the Utility’s request and at the sole discretion of each lender, the facilities may be extended for

additional periods. The revolving credit facilities may be used for working capital and other corporate purposes. The

Utility’s revolving credit facility may also be used for the repayment of commercial paper.

Provided certain conditions are met, PG&E Corporation and the Utility have the right to increase, in one or

more requests, given not more frequently than once a year, the aggregate lenders’ commitments under the revolving

credit facilities by up to $100 million and $500 million, respectively, in the aggregate for all such increases.

Borrowings under the revolving credit facilities (other than swingline loans) bear interest based, at PG&E

Corporation’s and the Utility’s election, on (1) a London Interbank Offered Rate (‘‘LIBOR’’) plus an applicable

margin or (2) the base rate plus an applicable margin. The base rate will equal the higher of the following: the

administrative agent’s announced base rate, 0.5% above the federal funds rate, or the one-month LIBOR plus an

applicable margin. Interest is payable quarterly in arrears, or earlier for loans with shorter interest periods. PG&E

Corporation and the Utility also will pay a facility fee on the total commitments of the lenders under the revolving

credit facilities. The applicable margins and the facility fees will be based on PG&E Corporation’s and the Utility’s

senior unsecured debt ratings issued by Standard & Poor’s Rating Services and Moody’s Investor Service. Facility fees

are payable quarterly in arrears.

The revolving credit facilities include usual and customary covenants for revolving credit facilities of this type,

including covenants limiting liens to those permitted under PG&E Corporation’s and the Utility’s senior note

indentures, mergers, sales of all or substantially all of PG&E Corporation’s and the Utility’s assets, and other

fundamental changes. In addition, the revolving credit facilities require that PG&E Corporation and the Utility

maintain a ratio of total consolidated debt to total consolidated capitalization of at most 65% as of the end of each

fiscal quarter. The $300 million revolving credit facility agreement also requires that PG&E Corporation own,

directly or indirectly, at least 80% of the common stock and at least 70% of the voting capital stock of the Utility. At

December 31, 2011, PG&E Corporation and the Utility were in compliance with all covenants under each of the

revolving credit facilities.

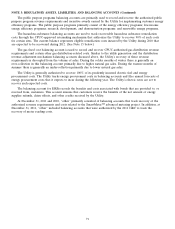

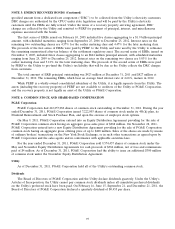

Commercial Paper Program

The Utility has a $1.75 billion commercial paper program, the borrowings from which are used primarily to

cover fluctuations in cash flow requirements. Liquidity support for these borrowings is provided by available capacity

under the Utility’s revolving credit facilities, as described above. The commercial paper may have maturities up to

365 days and ranks equally with the Utility’s other unsubordinated and unsecured indebtedness. Commercial paper

notes are sold at an interest rate dictated by the market at the time of issuance.

Other Short-term Borrowings

On November 22, 2011, the Utility issued $250 million principal amount of Floating Rate Senior Notes due

November 20, 2012. The interest rate for the Floating Rate Senior Notes is equal to the three-month LIBOR plus

0.45% and will reset quarterly beginning on February 20, 2012. At December 31, 2011, the interest rate on the

Floating Rate Senior Notes was 0.94%. For the year ended December 31, 2011, the average interest rate on the

Floating Rate Senior Notes was 0.94%.

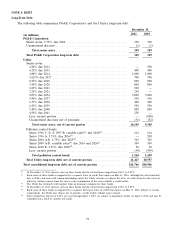

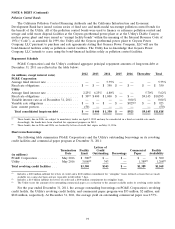

NOTE 5: ENERGY RECOVERY BONDS

In 2005, PERF issued two separate series of ERBs in the aggregate amount of $2.7 billion to refinance a

regulatory asset that the Utility recorded in connection with the Chapter 11 Settlement Agreement. The proceeds of

the ERBs were used by PERF to purchase from the Utility the right, known as ‘‘recovery property,’’ to be paid a

74