OfficeMax 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

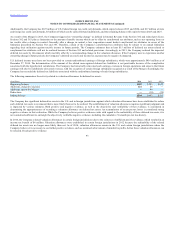

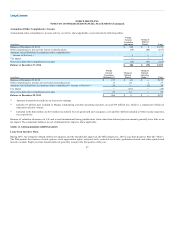

In 2009, Office Depot issued an aggregate of 350,000 shares of 10.00% Series A Redeemable Convertible Participating Perpetual Preferred Stock, par value

$0.01 per share, and 10.00% Series B Redeemable Conditional Convertible Participating Perpetual Preferred Stock, par value $0.01 per share, for $350

million (collectively, the “Redeemable Preferred Stock”). The Redeemable Preferred Stock was initially convertible into 70 million shares of Company

common stock and classified outside of permanent equity on the Consolidated Balance Sheets because certain redemption conditions were not solely within

the control of Office Depot.

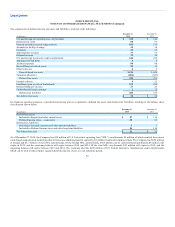

Dividends on the Redeemable Preferred Stock were declared quarterly and paid in cash or in-kind as approved by the Board of Directors. For accounting

purposes, dividends paid-in-kind were measured at fair value. Refer to Note 16 for additional fair value measurement information. Reported dividends

calculated on a per share basis were $221.50 and $94.10 for 2013 and 2012, respectively.

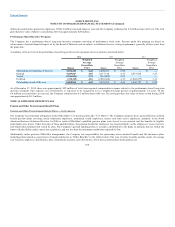

In accordance with certain Merger-related agreements, which the Company entered into with the holders of the Company’s preferred stock concurrently with

the execution of the Merger Agreement, in both July and November 2013, the Company redeemed 50 percent of the preferred stock outstanding. A total of

$431 million in cash was paid for the full redemption of the preferred stock in 2013, included the liquidation preference of $407 million and redemption

premium of $24 million measured at 6% of the liquidation preference.

Preferred stock dividends included in the Consolidated Statement of Operations for 2013 were $73 million, including $28 million of contractual dividends

and $45 million related to the redemptions. The $45 million is comprised of a $24 million redemption premium and $21 million representing the difference

between liquidation preference and carrying value of the preferred stock. The liquidation preference exceeded the carrying value because of initial issuance

costs and prior period paid-in-kind dividends recorded for accounting purposes at fair value. The $63 million indicated as Dividends on redeemable preferred

stock on the Consolidated Statement of Cash Flows is derived from the $73 million of 2013 dividends per the Consolidated Statement of Operations, reduced

by the $21 million non-cash difference between liquidation preference and carrying value, plus the payment of dividends accrued at the end of 2012.

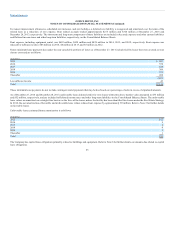

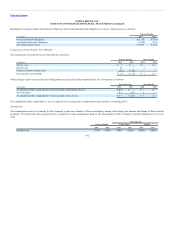

As of December 27, 2014 and December 28, 2013, there were 1,000,000 shares of $0.01 par value preferred stock authorized; no shares were issued and

outstanding.

At December 27, 2014, there were 5,915,268 common shares held in treasury. The Company’s Senior Secured Notes and the Facility include restrictions on

additional common stock repurchases, based on the Company’s liquidity and borrowing availability. There were no repurchases of common stock in 2014 or

2013.

96