OfficeMax 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

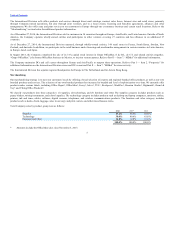

Table of Contents

One of our largest customer groups consists of various national and international governmental entities, government agencies and non-profit organizations,

such as purchasing consortiums. Contracting with U.S. state and local governments is highly competitive, subject to federal and state procurement laws,

requires more restrictive contract terms and can be expensive and time-consuming. Bidding such contracts often requires that we incur significant upfront

time and expense without any assurance that we will win a contract. Our ability to compete successfully for and retain business with the federal and various

state and local governments is highly dependent on cost-effective performance. Our business with governmental entities and agencies is also sensitive to

changes in national and international priorities and their respective budgets, which in the current economy continue to decrease. We also service a

substantial amount of business through agreements with purchasing consortiums and other sole- or limited-source distribution arrangements. If we are

unsuccessful in retaining these customers, or if there is a significant reduction in sales under any of these arrangements, it could adversely impact our

business and results of operations.

Our operating results and performance depend significantly on worldwide economic conditions and their impact on business and consumer spending. In the

past, the decline in business and consumer spending resulting from the global recession has caused our comparable store sales to continue to decline from

prior periods and we have experienced similar declines in most of our other domestic and international businesses. Our business and financial performance

may continue to be adversely affected by current and future economic conditions in the U.S. and internationally, including, without limitation, the level of

consumer debt, high levels of unemployment, higher interest rates and the ability of our customers to obtain credit, which may cause a continued or further

decline in business and consumer spending.

While fuel prices declined late in 2014, because these products are non-renewable resources, there can be no assurance that prices will not rise in the near

future even above past levels. We operate a large network of stores, delivery centers, and delivery vehicles around the globe. As such, we purchase significant

amounts of fuel needed to transport products to our stores and customers as well as shipping costs to import products from overseas. While we may hedge our

anticipated fuel purchases, the underlying commodity costs associated with this transport activity have been volatile in recent years and disruptions in

availability of fuel could cause our operating costs to rise significantly to the extent not covered by our hedges. Additionally, other commodity prices, such

as paper, may increase and we may not be able to pass along such costs to our customers. Fluctuations in the availability or cost of our energy and other

commodity prices could have a material adverse effect on our profitability.

We purchase products for resale under credit arrangements with our vendors and have been able to negotiate payment terms that are approximately equal in

length to the time it takes to sell the vendor’s products. When the global economy is experiencing weakness as it has over the last five years, vendors may

seek credit insurance to protect against non-payment of amounts due to them. If we continue to experience declining operating performance, and if we

experience severe liquidity challenges, vendors may demand that we accelerate our payment for their products or require cash on delivery, which could have

an adverse impact on our operating cash

15