OfficeMax 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

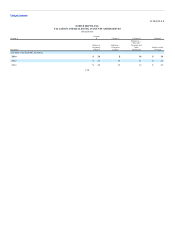

Table of Contents

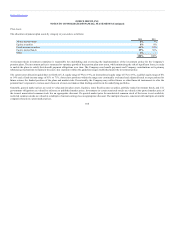

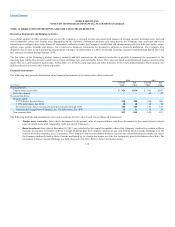

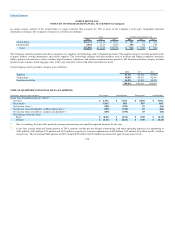

A review of the North American Retail portfolio during 2012 concluded with a plan for each location to maintain its current configuration, downsize to either

small or mid-size format, relocate, remodel, renew or close at the end of the base lease term. The asset impairment analysis previously had assumed at least

one optional lease renewal. Additionally, projected sales trends included in the impairment calculation model in prior periods were reduced. These changes,

and continued store performance, served as a basis for the Company’s asset impairment review for 2012.

The Company will continue to evaluate initiatives to improve performance and lower operating costs. To the extent that forward-looking sales and operating

assumptions are not achieved and are subsequently reduced, or in certain circumstances, even if store performance is as anticipated, additional impairment

charges may result. However, at the end of 2014, the impairment analysis reflects the Company’s best estimate of future performance.

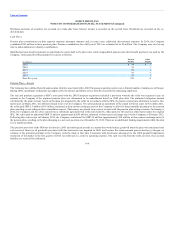

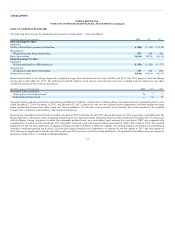

Indefinite-lived intangible assets — During 2014, the Company reassessed its use of a private brand trade name used internationally, that previously had

been assigned an indefinite life. The expected change in profile and life of this brand, along with assigning an estimated life of three years, resulted in an

impairment charge of $5 million. This charge is not included in determination of Division operating income. The estimated fair value was calculated based

on a discounted relief from royalty method using Level 3 inputs.

Goodwill associated with the Merger has been allocated to the reporting units for the purposes of the annual goodwill impairment test. The estimated fair

value of each reporting unit exceeds its carrying value at the test date. The reporting unit of Australia and New Zealand, which was not combined with any

existing Office Depot businesses, has an estimated fair value approximately 10% above its carrying value. Goodwill in that reporting unit is $15 million. The

estimated fair value of this reporting unit includes projected cash outflows related to certain restructuring activities. Should these restructuring activities not

result in the anticipated future period benefits, or if there is a downturn in performance, a potential future goodwill impairment could result. However, the

Company believes, based on these projections, that there are no current indicators of impairment in this reporting unit. The estimated fair values of the other

reporting units, which were combined with existing Office Depot businesses, were substantially in excess of their carrying values.

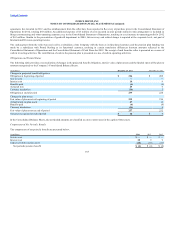

As of December 29, 2012, goodwill of $45 million (at then-current exchange rates) was included in the International Division in a reporting unit comprised of

wholly-owned operating subsidiaries in Europe and ownership of the joint venture operating in Mexico. The total estimated fair value of the reporting unit

exceeded its carrying value by approximately 30%, however, a substantial majority of that excess value was associated with the joint venture. In 2013, when

the reporting unit sold its investment in the joint venture and distributed essentially all of the after tax proceeds to its U.S. parent, the fair value fell below its

carrying value. Because the investment was accounted for under the equity method, no goodwill was allocated to the gain on disposition of joint venture

calculation. However, concurrent with the sale and gain recognition, a goodwill impairment charge of $44 million was recognized.

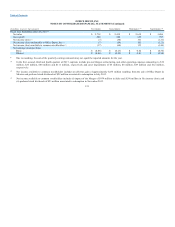

Software and Definite-lived intangible assets — Asset impairment charges for 2014 include $12 million resulting from a decision to convert certain websites

to a common platform, $28 million related to the abandonment of a software implementation project in Europe, and $13 million write off of capitalized

software following certain information technology platform decisions related to the Merger.

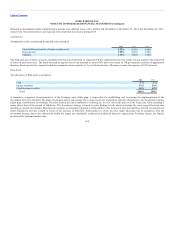

Following identification of retail stores for closure as part of the Real Estate Strategy, the related favorable lease assets were assessed for accelerated

amortization or impairment. Considerations included the Level 3 projected

114