OfficeMax 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

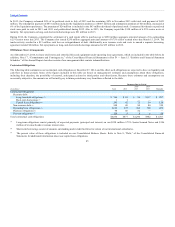

associated with facility closures that are deemed operational are included in Selling, general and administrative expenses.

Pensions and other postretirement benefits — In addition to an existing but closed defined benefit plan in Europe, the Company assumed responsibility for

certain OfficeMax noncontributory defined benefit pension plans and retiree medical benefit and life insurance plans. The OfficeMax plans are frozen and do

not allow new entrants. At December 27, 2014, the funded status of our existing and assumed OfficeMax defined benefit pension and other postretirement

benefit plans was a liability of $196 million. Changes in assumptions related to the measurement of funded status could have a material impact on the

amount reported. We are required to calculate our pension expense and liabilities using actuarial assumptions, including mortality assumptions, a discount

rate and long-term asset rate of return. For year end 2014 measurement, we updated North America benefit plans’ mortality assumptions based on tables

recently-published by Society of Actuaries’ Retirement Plan Experience Committee. We do not anticipate changes to those assumptions in the near future.

We base our North America plans’ discount rate assumption on the rates of return for a theoretical portfolio of high-grade corporate bonds (rated AA- or

better) with cash flows that generally match our expected benefit payments in future years. The discount rate for the European plan is derived based on long-

term UK government fixed income yields, having regard to the proportion of assets in each asset class. We base our long-term asset rate of return assumption

on the average rate of earnings expected on invested assets. Based on current market conditions, both the discount rate and the assumed long-term rate of

return on plan assets decreased for year end 2014 measurements. Currently, the net impact of these plans is an annual credit to income. However, because of

the judgments and estimates included in pension and other benefit valuation, such amount could change in future periods and have a significant impact on

our financial position and results of operations. A 50 basis point reduction in the discount rate would increase the 2015 pension expense credit by $2 million.

A 50 basis point reduction in the assumed long-term rate of return on plan assets would reduce the 2015 net pension credit by $6 million.

Income taxes — Income tax accounting requires management to make estimates and apply judgments to events that will be recognized in one period under

rules that apply to financial reporting and in a different period in our tax returns. In particular, judgment is required when estimating the value of future tax

deductions, tax credits, and the realizability of net operating loss carryforwards (NOLs), as represented by deferred tax assets. When we believe the realization

of all or a portion of a deferred tax asset is not likely, we establish a valuation allowance. Changes in judgments that increase or decrease these valuation

allowances impact current earnings. Our effective tax rate in future periods may be positively or negatively impacted by changes in related judgments about

valuation allowances or pre-tax operations.

In addition to judgments associated with valuation accounts, our current tax provision can be affected by our mix of income and identification or resolution

of uncertain tax positions. Because income from domestic and international sources may be taxed at different rates, the shift in mix during a year or over years

can cause the effective tax rate to change. We base our rate during the year on our best estimate of an annual effective rate, and update that estimate quarterly,

with the cumulative effect of a change in the anticipated annual rate reflected in the tax provision of that period. Such changes can result in significant

interim reporting volatility. This volatility can result from changes in our projected earnings levels, the mix of income, the impact of valuation allowances in

certain jurisdictions and the interim accounting rules applied to entities expected to pay taxes on a full year basis, but recognizing losses in an interim

period.

Competitive Factors — Over the years, we have seen continued development and growth of competitors in all segments of our business. In particular, mass

merchandisers and warehouse clubs, as well as grocery and drugstore chains, have increased their assortment of office merchandise. Warehouse clubs have

expanded beyond their in-store assortment by adding catalogs and websites from which a much broader assortment of products may be ordered. We also face

competition from other office supply stores that compete with us in numerous markets. This competition is likely to result in increased competitive pressures

on pricing, product selection and

50