OfficeMax 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Advertising costs are charged either to Selling, general and administrative expenses when incurred or, in the case of direct marketing

advertising, capitalized and amortized in proportion to the related revenues over the estimated life of the materials, which range from several months to up to

one year.

Advertising expense recognized was $447 million in 2014, $378 million in 2013 and $402 million in 2012. Prepaid advertising costs were $21 million as of

December 27, 2014 and $26 million as of December 28, 2013.

Compensation expense for all share-based awards expected to vest is measured at fair value on the date of grant and recognized

on a straight-line basis over the related service period. The Black-Scholes valuation model is used to determine the fair value of stock options. The fair value

of restricted stock and restricted stock units, including performance-based awards, is determined based on the Company’s stock price on the date of grant. The

Merger-date value of former OfficeMax share-based awards was valued using the Black-Scholes model and apportioned between Merger consideration and

unearned compensation to be recognized in expense as earned in future periods based on remaining service periods.

Office Depot is primarily self-insured for workers’ compensation, auto and general liability and employee medical insurance programs. The

Company has stop-loss coverage to limit the exposure arising from these claims. Self-insurance liabilities are based on claims filed and estimates of claims

incurred but not reported. These liabilities are not discounted.

The Company enters into arrangements with substantially all significant vendors that provide for some form of consideration to be

received from the vendors. Arrangements vary, but some specify volume rebate thresholds, advertising support levels, as well as terms for payment and other

administrative matters. The volume-based rebates, supported by a vendor agreement, are estimated throughout the year and reduce the cost of inventory and

cost of goods sold during the year. This estimate is regularly monitored and adjusted for current or anticipated changes in purchase levels and for sales

activity. Other promotional consideration received is event-based or represents general support and is recognized as a reduction of Cost of goods sold and

occupancy costs or Inventories, as appropriate based on the type of promotion and the agreement with the vendor. Certain arrangements meet the specific,

incremental, identifiable criteria that allow for direct operating expense offset, but such arrangements are not significant.

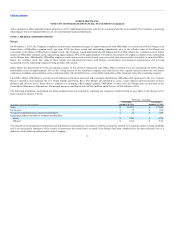

The Company sponsors certain closed U.S. and international defined benefit pension plans, certain closed U.S.

retiree medical benefit and life insurance plans, as well as a Canadian retiree medical benefit plan open to certain employees.

The Company recognizes the funded status of its defined benefit pension, retiree medical benefit and life insurance plans in the Consolidated Balance Sheets,

with changes in the funded status recognized through accumulated other comprehensive income (loss), net of tax, in the year in which the changes occur.

Actuarially-determined liabilities related to pension and postretirement benefits are recorded based on estimates and assumptions. Factors used in developing

estimates of these liabilities include assumptions related to discount rates, rates of return on investments, healthcare cost trends, benefit payment patterns and

other factors. The Company also updates periodically its assumptions about employee retirement factors, mortality, and turnover. Refer to Note 14 for

additional details.

Environmental and asbestos liabilities relate to acquired legacy paper and forest products businesses and timberland

assets. The Company accrues for losses associated with these obligations when probable and reasonably estimable. These liabilities are not discounted. A

receivable for insurance recoveries is recorded when probable.

73