OfficeMax 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

with a cumulative effect adjustment upon adoption in 2017. Additional disclosures will also be required under the new standard. The Company is assessing

what impacts this new standard will have on its Consolidated Financial Statements.

On November 5, 2013, the Company completed its previously announced merger of equals transaction with OfficeMax. In connection with the Merger, each

former share of OfficeMax common stock, par value $2.50 per share, issued and outstanding immediately prior to the effective time of the Merger was

converted to 2.69 shares of Office Depot common stock. The Company issued approximately 240 million shares of Office Depot, Inc. common stock to former

holders of OfficeMax common stock, representing approximately 45% of the approximately 530 million total shares of Company common stock outstanding

on the Merger date. Additionally, OfficeMax employee stock options and restricted stock were converted into mirror awards exercisable or earned in Office

Depot, Inc. common stock. The value of these awards was apportioned between total Merger consideration and unearned compensation and is being

recognized over the remaining original vesting periods of the awards.

Office Depot was determined to be the accounting acquirer. In this all-stock transaction only Office Depot common stock was transferred, the Office Depot

shareholders received approximately 55% of the voting interest of the combined company and other factors were equally shared between the two former

companies, including representation on the combined entity’s Board of Directors, or were further indicators of the Company being the accounting acquirer.

Like Office Depot, OfficeMax is a leader in both business-to-business and retail office products distribution. OfficeMax had operations in the U.S., Canada,

Mexico, Australia, New Zealand, the U.S. Virgin Islands and Puerto Rico. The Merger was intended to create a more efficient global provider of these

products and services that is better able to compete in a changing office supply industry. OfficeMax’s results since the Merger date are included in the

Consolidated Statement of Operations. The merged business contributed sales of $939 million and a Net loss of $39 million in 2013.

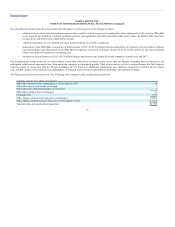

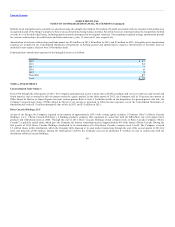

The following unaudited consolidated pro forma summary has been prepared by adjusting the Company’s historical data to give effect to the Merger as if it

had occurred on January 1, 2012:

(In millions, except per share amounts)

Sales $ 16,879 $ 17,640

Net income $ 33 $ 262

Net income attributable to common stockholders $ 31 $ 258

Earnings per share available to common stockholders

Basic $ 0.06 $ 0.50

Diluted $ 0.06 $ 0.49

The unaudited consolidated pro forma financial information was prepared in accordance with the acquisition method of accounting under existing standards

and is not necessarily indicative of the results of operations that would have occurred if the Merger had been completed on the date indicated, nor is it

indicative of the future operating results of the Company.

75