OfficeMax 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The unaudited pro forma results have been adjusted with respect to certain aspects of the Merger to reflect:

• additional depreciation and amortization expenses that would have been recognized assuming fair value adjustments to the existing OfficeMax

assets acquired and liabilities assumed, including property and equipment, favorable and unfavorable lease values, the Timber Notes and Non-

recourse debt, and share-based compensation awards;

• valuation allowances on U.S. deferred tax assets limited deferred tax benefit recognition;

• elimination of the OfficeMax recognition of deferred gain in 2013 of $138 million from the disposition of a portion of its investment in Boise

Cascade Holdings and elimination of the OfficeMax recognition of pension settlement charges in 2012 of $56 million as the related deferred

values were removed in purchase accounting; and

• inclusion in the pro forma year 2012 of $79 million Merger transaction costs incurred by both companies through year end 2013.

The unaudited pro forma results do not reflect future events that either have occurred or may occur after the Merger, including, but not limited to, the

anticipated realization of ongoing savings from operating synergies in subsequent periods. They also do not give effect to certain charges that the Company

expects to incur in connection with the Merger, including, but not limited to, additional professional fees, employee integration, retention and severance

costs, facility closure costs, potential asset impairments, accelerated depreciation and amortization or product rationalization charges.

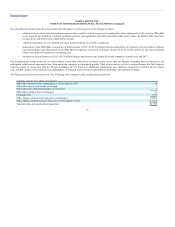

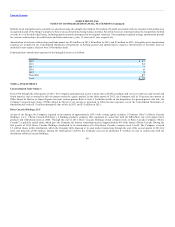

The Merger was an all-stock transaction. The following table summarizes the consideration transferred.

(In millions, except for share exchange ratio and price)

OfficeMax common shares outstanding as of November 5, 2013 88

OfficeMax share-based awards exchanged 3

OfficeMax Series D preferred shares, as converted 1

OfficeMax common shares exchanged 92

Exchange ratio 2.69

Office Depot common stock issued for consideration 246.9

Office Depot common stock per share price on November 5, 2013 $ 5.65

Total fair value of consideration transferred $1,395

76