OfficeMax 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

exchange rates). The gain is net of third party fees, as well as recognition of $39 million of cumulative translation loss released from other comprehensive

income because the subsidiary holding the investment was substantially liquidated. The removal of this investment from the related reporting unit resulted in

an impairment of goodwill. Both the gain on disposition and the related impairment charge were recognized at the Corporate level and not included in the

determination of Division income.

Other income (expense), net includes gains and losses related to foreign exchange transactions, losses on sales of the Boise Cascade Company stock received

by the Company following the Merger, investment results from deferred compensation plans, and prior to the sale in July 2013, our portion of the Office

Depot de Mexico joint venture income. Our portion of the joint venture results for the year-to-date 2013 was $13 million compared to $32 million in 2012.

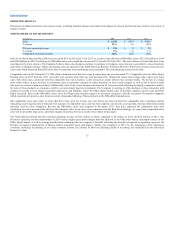

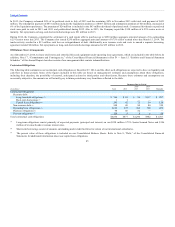

(In millions) 2013 2012

Income tax expense (benefit) $ 147 $ 2

Effective income tax rate* 116% (2)%

* Income taxes as a percentage of income (loss) before income taxes.

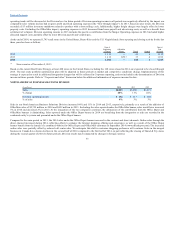

The 2014 effective tax rate is negative because we recognized tax expense in jurisdictions with pretax income but were precluded from recognizing deferred

tax benefits on pretax losses in the U.S. and certain foreign jurisdictions with valuation allowances. In addition, no benefit was recognized for certain non-

deductible expenses, including foreign interest expense. The effective tax rate for 2014 also reflects a benefit for our international operations in jurisdictions

with statutory tax rates that are lower than the aggregate U.S. federal and state income tax rates, as well as jurisdictions in which we have favorable tax

rulings.

The significant 2013 effective tax rate is primarily attributable to $140 million of U.S. and Mexico income tax expense resulting from the sale of our

investment in Office Depot de Mexico. The sale of our interest in Grupo OfficeMax during 2014 did not generate a similar gain or income tax expense. The

2013 effective tax rate also includes certain Merger related expenses and the International Division’s goodwill impairment that are not deductible for income

tax purposes. For 2012, the effective tax rate includes a $16 million benefit related to the favorable settlement of the U.S. Internal Revenue Service (“IRS”)

examination of the 2009 and 2010 tax years and a $22 million benefit related to the pension settlement since it was a non-taxable purchase price adjustment.

Both 2013 and 2012 effective tax rates reflect the impact of valuation allowances limiting the recognition of deferred tax assets, as well as the benefit of

lower statutory tax rates and favorable rulings in our international operations, as described above for 2014.

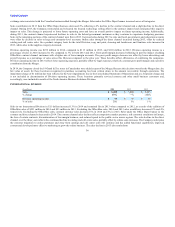

Following the recognition of significant valuation allowances in 2009, we have regularly experienced substantial volatility in our effective tax rate in

interim periods and across years. Because deferred income tax benefits cannot be recognized in several jurisdictions, changes in the amount, mix and timing

of pretax earnings among jurisdictions can have a significant impact on the overall effective tax rate. This interim and full year volatility is likely to continue

in future periods until the valuation allowances can be released.

We file a U.S. federal income tax return and other income tax returns in various states and foreign jurisdictions. The U.S. federal income tax return for 2013 is

under concurrent year review. Generally, we are subject to routine examination for years 2008 and forward in our foreign jurisdictions and for years 2009 and

forward in our state jurisdictions. The acquired OfficeMax U.S. consolidated group is no longer subject to U.S. federal and state income tax examinations for

years before 2010 and 2006, respectively. It is reasonably possible that some audits will close within the next twelve months, which we do not believe would

result in a change to our accrued uncertain tax positions.

Refer to Note 9, “Income Taxes,” in the Notes to Consolidated Financial Statements for additional tax discussion.

41