OfficeMax 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

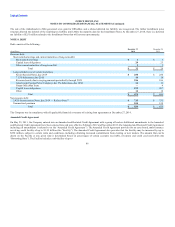

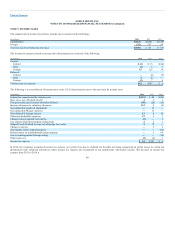

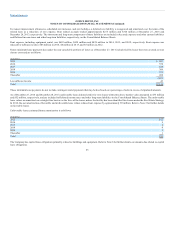

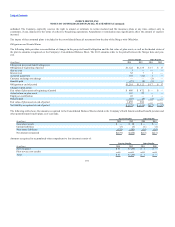

The components of deferred income tax assets and liabilities consisted of the following:

(In millions)

December 28,

2013

U.S. and foreign net operating loss carryforwards $ 314

Deferred rent credit 97

Pension and other accrued compensation 170

Accruals for facility closings 38

Inventory 25

Self-insurance accruals 33

Deferred revenue 34

U.S. and foreign income tax credit carryforwards 234

Allowance for bad debts 8

Accrued expenses 60

Basis difference in fixed assets 15

Other items, net 6

Gross deferred tax assets 1,034

Valuation allowance (683)

Deferred tax assets 351

Internal software 22

Installment gain on sale of timberlands 258

Deferred Subpart F income 23

Undistributed foreign earnings 12

Deferred tax liabilities 315

Net deferred tax assets $ 36

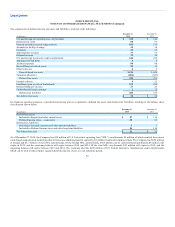

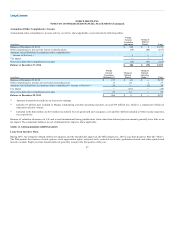

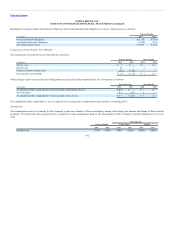

For financial reporting purposes, a jurisdictional netting process is applied to deferred tax assets and deferred tax liabilities, resulting in the balance sheet

classification shown below.

(In millions)

December 28,

2013

Deferred tax assets:

Included in Prepaid and other current assets $ 114

Deferred income taxes — noncurrent 35

Deferred tax liabilities:

Included in Accrued expenses and other current liabilities 3

Included in Deferred income taxes and other long-term liabilities 110

Net deferred tax asset $ 36

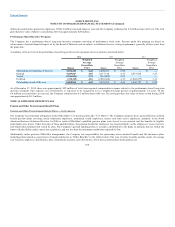

As of December 27, 2014, the Company has $39 million of U.S. Federal net operating loss (“NOL”) carryforwards, $9 million of which resulted from excess

stock-based compensation deductions that will increase additional paid-in capital by $3 million if realized in future periods. The Company has $852 million

of foreign and $1.7 billion of state NOL carryforwards. Of the foreign NOL carryforwards, $668 million can be carried forward indefinitely, $8 million will

expire in 2015, and the remaining balance will expire between 2016 and 2034. Of the state NOL carryforwards, $23 million will expire in 2015, and the

remaining balance will expire between 2016 and 2034. The Company also has $109 million of U.S. Federal alternative minimum tax credit carryforwards,

which can be used to reduce future regular federal income tax, if any, over an indefinite period.

92