OfficeMax 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

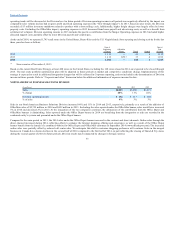

On February 4, 2015, Staples and the Company announced that the companies have entered into a definitive merger agreement (the “Staples Merger

Agreement”), under which Staples will acquire all of the outstanding shares of Office Depot and the Company will become a wholly owned subsidiary of

Staples (the “Staples Acquisition”). Under the terms of the Staples Merger Agreement, Office Depot shareholders will receive, for each Office Depot share held

by such shareholders, $7.25 in cash and 0.2188 of a share in Staples common stock at closing. Each employee share-based award outstanding at the date of

the agreement will vest upon the effective date of the Staples Acquisition. The transaction has been approved by both companies’ Board of Directors and the

completion of the Staples Acquisition is subject to customary closing conditions including, among others, the approval of Office Depot shareholders and

various regulatory approvals. Certain existing debt agreements will require modification prior to closing. The transaction is anticipated to close before the

end of 2015. Refer to the Company’s Form 8-K filed February 4, 2015 for additional information on the transaction. We cannot guarantee that the Staples

Merger will be completed or that, if completed, it will be exactly on the terms as set forth in the Staples Merger Agreement. Should the Staples Acquisition

not be completed, the Company will continue to be responsible for payment of commitments to current employees under retention arrangements and may

either receive or pay a breakup fee, as provided for in the Staples Merger Agreement.

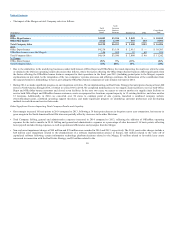

Our business is comprised of three segments. The North American Retail Division includes our retail stores in the United States, including Puerto Rico and

the U.S. Virgin Islands, which offer office supplies, technology products and solutions, business machines and related supplies, facilities products, and office

furniture. Most stores also have a copy and print center offering printing, reproduction, mailing and shipping. The North American Business Solutions

Division sells office supply products and services in Canada and the United States, including Puerto Rico and the U.S. Virgin Islands. North American

Business Solutions Division customers are served through dedicated sales forces, through catalogs, telesales, and electronically through our Internet sites.

Our International Division sells office products and services through direct mail catalogs, contract sales forces, Internet sites, and retail stores in Europe and

Asia/Pacific. The former OfficeMax business in Mexico is presented as an Other segment. The integration of this business into the International Division was

suspended in the second quarter of 2014 due to the sale and it was managed and reported independently of the Company’s other international businesses

through the date of the sale. Prior period segment information has been recast to reflect this change in reporting structure.

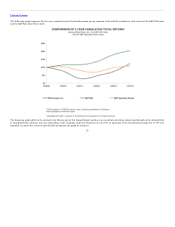

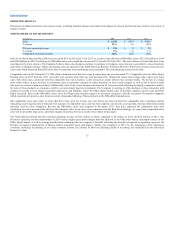

A summary of factors important to understanding our results for 2014 is provided below. A more detailed comparison to prior years is included in the

narrative that follows this overview.

Merger

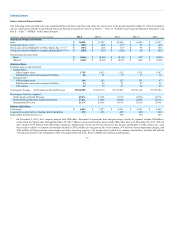

• On November 5, 2013, the Company completed its Merger with OfficeMax. OfficeMax’s financial results since the Merger date are included in our 2013

and 2014 Consolidated Statements of Operations, affecting comparability of the full year amounts. Due to the significance of the OfficeMax results to the

Company, the OfficeMax sales and operating expense categories, as well as the Merger-related integration and restructuring activities in the twelve

months of 2014, are the main drivers of the changes in results of operations when compared to the 2013 results.

29