OfficeMax 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

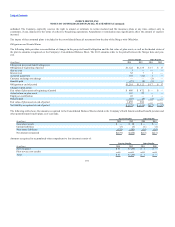

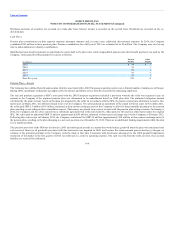

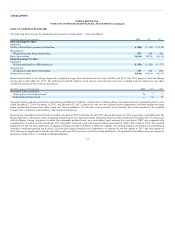

agreement, fees incurred in 2012, and fee reimbursement from the seller have been reported in Recovery of purchase price in the Consolidated Statement of

Operations for 2012, totaling $68 million. An additional expense of $5 million of costs incurred in prior periods related to this arrangement is included in

Merger, restructuring and other operating expenses, net, in the Consolidated Statement of Operations, resulting in a net increase in operating profit for 2012

of $63 million. Similar to the presentation of goodwill impairment in 2008, this recovery and related charge is reported at the corporate level, not part of

International Division operating income.

The cash payment from the seller was received by a subsidiary of the Company with the Euro as its functional currency and the pension plan funding was

made by a subsidiary with Pound Sterling as its functional currency, resulting in certain translation differences between amounts reflected in the

Consolidated Statement of Operations and the Consolidated Statement of Cash Flows for 2012. The receipt of cash from the seller is presented as a source of

cash in investing activities. The contribution of cash to the pension plan is presented as a use of cash in operating activities.

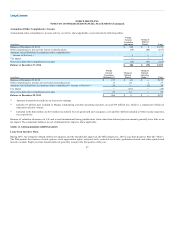

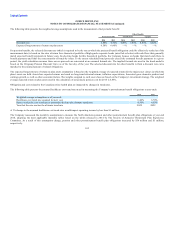

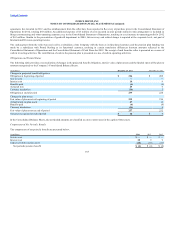

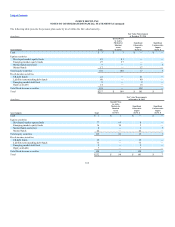

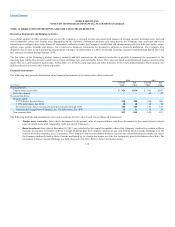

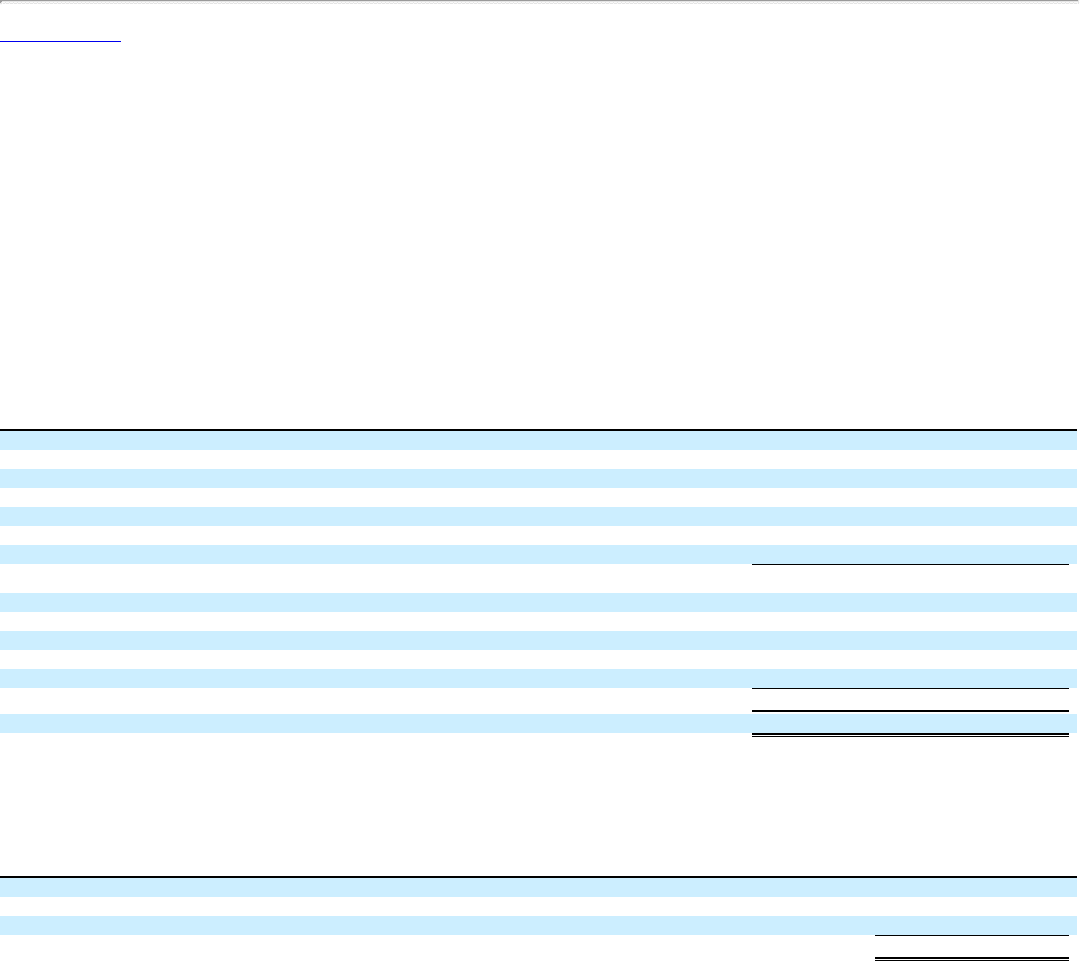

Obligations and Funded Status

The following table provides a reconciliation of changes in the projected benefit obligation, the fair value of plan assets and the funded status of the plan to

amounts recognized on the Company’s Consolidated Balance Sheets.

(In millions) December 29, 2013

Changes in projected benefit obligation:

Obligation at beginning of period $ 208

Service cost —

Interest cost 9

Benefits paid (4)

Actuarial loss 6

Currency translation 5

Obligation at end of period 224

Changes in plan assets:

Fair value of plan assets at beginning of period 216

Actual return on plan assets 14

Benefits paid (4)

Currency translation 6

Fair value of plan assets at end of period 232

Net asset recognized at end of period $ 8

In the Consolidated Balance Sheets, the net funded amounts are classified as a non-current asset in the caption Other assets.

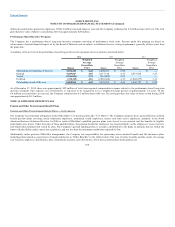

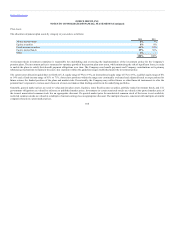

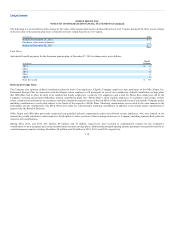

Components of Net Periodic Benefit

The components of net periodic benefit are presented below:

(In millions) 2013 2012

Service cost $ — $ —

Interest cost 9 9

Expected return on plan assets (13) (11)

Net periodic pension benefit $ (4) $ (2)

107