OfficeMax 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

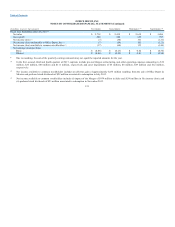

cash flows discussed above, the net book value of operating assets and favorable lease assets, and likely sublease over the option period after closure or return

of property to landlords. Impairment of $5 million was recognized during 2014.

During 2011, the Company acquired an office supply company in Sweden to supplement the existing business in that market. As a result of slowing

economic conditions in Sweden after the acquisition, difficulties in the consolidation of multiple distribution centers and the adoption of new warehousing

systems which impacted customer service and delayed or undermined planned marketing activities, the Company re-evaluated remaining balances of

acquisition-related intangible assets of customer relationships and short-lived trade name values. Cash flows related to these acquired customer relationships

with the updated Level 3 inputs were projected to be negative, then recovering, but were insufficient to recover the intangible assets’ remaining carrying

values. Accordingly, an impairment charge of approximately $14 million was recognized during the third quarter of 2012.

Prior to redemption of the Company’s Redeemable Preferred Stock in 2013, any dividends paid-in-kind were measured at fair value, using a Level 3 measure.

The Company used a binomial simulation to capture the call, conversion, and interest rate reset features as well the optionality of paying the dividend in-

kind or in cash. Dividends were paid in kind for the first three quarters of 2012.

For dividends paid-in-kind for the three quarters of 2012, the average stock price volatility was 63%, the risk free rate was 3.0% and the risk adjusted rate was

14.5%. The aggregate fair value calculated for these three quarters was $22.8 million, $6.3 million below the amount added to the liquidation preference. For

the dividend paid-in-kind for the third quarter of 2012, a stock price volatility of 55% or 75% would have increased the estimate by $0.7 million or decreased

the estimate by $0.6 million, respectively. Using a beginning of period stock price of $1.50 or $3.50 would have decreased the estimate by $1.7 million or

increased the estimate by $1.1 million, respectively. Assuming that all future dividends would be paid in cash would have increased the estimate by

$1.3 million. Assuming all future dividends would be paid-in-kind had no significant impact. Refer to Note 11 for additional information.

There were no significant differences between the carrying values and fair values of the Company’s financial instruments as of December 27, 2014 and

December 28, 2013, except as disclosed above.

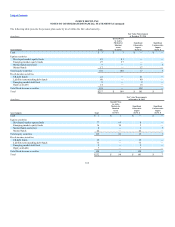

On June 25, 2011, OfficeMax, with which the Company merged in November 2013, entered into a paper supply contract with Boise White Paper, L.L.C.

(“Boise Paper”), under which OfficeMax agreed to purchase office papers from Boise Paper, and Boise Paper has agreed to supply office paper to OfficeMax,

subject to the terms and conditions of the paper supply contract. The paper supply contract replaced the previous supply contract executed in 2004 with

Boise Paper. The Company assumed the commitment under a paper supply contract to buy OfficeMax’s North American requirements for office paper, subject

to certain conditions, including conditions under which the Company may purchase paper from paper producers other than Boise Paper. The paper supply

contract’s term will expire on December 31, 2017, followed by a gradual reduction of the Company’s purchase requirements over a two year period thereafter.

However, if certain circumstances occur, the agreement may be terminated earlier. If terminated, it will be followed by a gradual reduction of the Company’s

purchase requirements over a two year period. Purchases under the agreement were $647 million in 2014 and $87 million in the period from Merger date

through year-end 2013.

115