OfficeMax 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

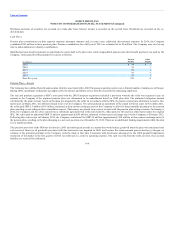

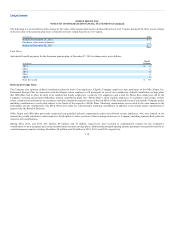

million unvested shares granted to employees. Of the 9 million unvested shares at year end, the Company estimates that 8.6 million shares will vest. The total

grant date fair value of shares vested during 2014 was approximately $20 million.

The Company has a performance-based long-term incentive program consisting of performance stock units. Payouts under this program are based on

achievement of certain financial targets set by the Board of Directors and are subject to additional service vesting requirements, generally of three years from

the grant date.

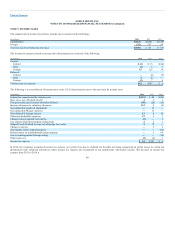

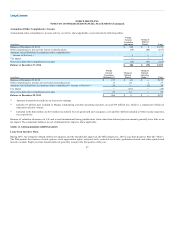

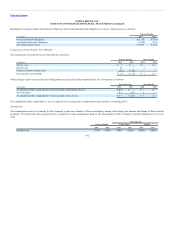

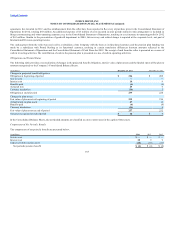

A summary of the activity in the performance-based long-term incentive program since inception is presented below.

2013 2012

Shares

Weighted

Average

Grant-Date

Price Shares

Weighted

Average

Grant-Date

Price

Outstanding at beginning of the year 1,030,753 $ 3.25 — $ —

Granted 4,317,314 4.55 2,073,628 3.25

Vested (261,095) 3.63 — —

Forfeited (2,010,680) 4.15 (1,042,875) 3.32

Outstanding at end of the year 3,076,292 $ 4.45 1,030,753 $ 3.25

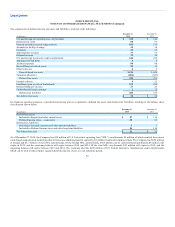

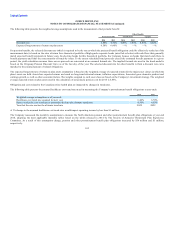

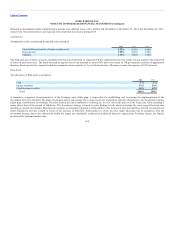

As of December 27, 2014, there was approximately $22 million of total unrecognized compensation expense related to the performance-based long-term

incentive program. This expense, net of forfeitures, is expected to be recognized over a weighted-average period of approximately 2.2 years. Of the

6.8 million unvested shares at year end, the Company estimates that 6.2 million shares will vest. The total grant date fair value of shares vested during 2014

was approximately $6.3 million.

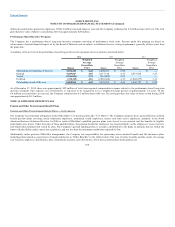

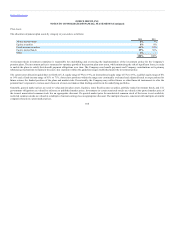

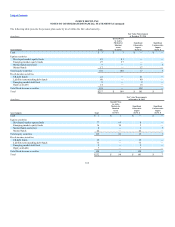

Pension and Other Postretirement Benefit Plans — North America

The Company has retirement obligations under OfficeMax’s U.S. pension plans (the “U.S. Plans”). The Company sponsors these noncontributory defined

benefit pension plans covering certain terminated employees, terminated vested employees, retirees and some active employees, primarily in the North

American Business Solutions Division. In 2004 or earlier, OfficeMax’s qualified pension plans were closed to new entrants and the benefits of eligible

participants were frozen. Under the terms of these qualified plans, the pension benefit for employees was based primarily on the employees’ years of service

and benefit plan formulas that varied by plan. The Company’s general funding policy is to make contributions to the plans in amounts that are within the

limits of deductibility under current tax regulations, and not less than the minimum contribution required by law.

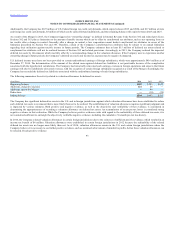

Additionally, under previous OfficeMax arrangements, the Company has responsibility for sponsoring retiree medical benefit and life insurance plans

including plans related to operations in Canada (referred to as “Other Benefits” in the tables below). The type of retiree benefits and the extent of coverage

vary based on employee classification, date of retirement, location, and other factors. All of these postretirement medical plans are

100