OfficeMax 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

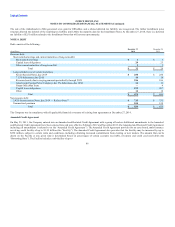

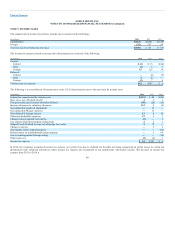

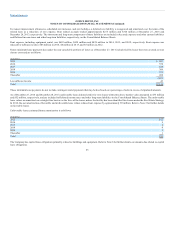

The components of income (loss) before income taxes consisted of the following:

(In millions) 2013 2012

United States $(230) $(129)

Foreign 357 54

Total income (loss) before income taxes $ 127 $ (75)

The income tax expense related to income (loss) from operations consisted of the following:

(In millions) 2013 2012

Current:

Federal $ 15 $(14)

State 5 1

Foreign 125 14

Deferred :

Federal (4) (5)

State (1) —

Foreign 7 6

Total income tax expense $147 $ 2

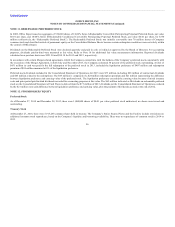

The following is a reconciliation of income taxes at the U.S. Federal statutory rate to the provision for income taxes:

(In millions) 2013 2012

Federal tax computed at the statutory rate $ 44 $(26)

State taxes, net of Federal benefit 3 1

Foreign income taxed at rates other than Federal (28) (15)

Increase (decrease) in valuation allowance 8 (9)

Non-deductible goodwill impairment 15 —

Non-deductible Merger expenses 13 —

Non-deductible foreign interest 8 10

Other non-deductible expenses 4 3

Change in unrecognized tax benefits — 1

Tax expense from intercompany transactions 2 2

Subpart F and dividend income, net of foreign tax credits 75 —

Change in tax rate 2 2

Non-taxable return of purchase price — (22)

Deferred taxes on undistributed foreign earnings 5 68

Tax accounting method change ruling — (16)

Other items, net (4) 3

Income tax expense $147 $ 2

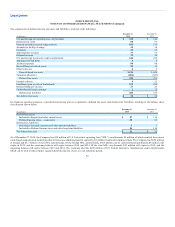

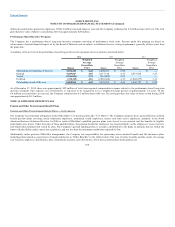

In 2014, the Company recognized income tax expense on a pretax loss due to deferred tax benefits not being recognized on pretax losses in certain tax

jurisdictions with valuation allowances, while income tax expense was recognized in tax jurisdictions with pretax income. The decrease in income tax

expense from 2013 to 2014 is

90