OfficeMax 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

services provided. Many of these retail competitors, including discounters, warehouse clubs, and drug stores and grocery chains, carry a wide assortment of

office supply products. Some of them also feature technology products. Many of them may price certain of these offerings lower than we do. This trend

towards a proliferation of retailers offering a limited assortment of office products is a potentially serious trend in our industry that could shift purchasing

away from office supply specialty retailers and adversely impact our results.

We have seen substantial growth in the number of competitors that offer office products over the Internet, as well as the breadth and depth of their product

offerings. In addition to large numbers of smaller Internet providers featuring special price incentives and one-time deals (such as close-outs), we are

experiencing strong competitive pressures from large Internet providers such as Amazon.com and Walmart that offer a full assortment of office products

through direct sales and, in the case of Amazon.com, acting as a “storefront” for other specialty office product providers.

Additionally, consumers are utilizing more technology and purchasing less paper, ink and toner, physical file storage and general office supplies.

We regularly consider these and other competitive factors when we establish both offensive and defensive aspects of our overall business strategy and

operating plans.

Economic Factors — Our customers in the North American Retail Division, the International Division, and many of our customers in the North American

Business Solutions Division are predominantly small and home office businesses. Accordingly, spending by these customers is affected by macroeconomic

conditions, such as changes in the housing market and commodity costs, credit availability and other factors. The downturn in the global economy

experienced in recent years negatively impacted our sales and profits.

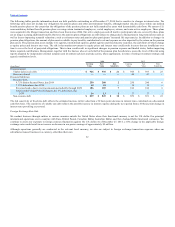

Liquidity Factors — Our cash flow from operating activities, available cash and cash equivalents, and access to broad financial markets provide the liquidity

we need to operate our business and fund integration and restructuring activities. Together, these sources have been used to fund operating and working

capital needs, as well as invest in business expansion through new store openings, capital improvements and acquisitions. We have in place a $1.25 billion

asset based credit facility to provide liquidity, subject to availability as specified in the agreement.

We have adopted an enterprise risk management process patterned after the principles set out by the Committee of Sponsoring Organizations (COSO).

Management utilizes a common view of exposure identification and risk management. A process is in place for periodic risk reviews and identification of

appropriate mitigation strategies.

We have market risk exposure related to interest rates, foreign currency exchange rates, and commodities. Market risk is measured as the potential negative

impact on earnings, cash flows or fair values resulting from a hypothetical change in interest rates or foreign currency exchange rates over the next year.

Interest rate changes on obligations may result from external market factors, as well as changes in our credit rating. We manage our exposure to market risks at

the corporate level. The portfolio of interest-sensitive assets and liabilities is monitored to provide liquidity necessary to satisfy anticipated short-term needs.

Our risk management policies allow the use of specified financial instruments for hedging purposes only; speculation on interest rates, foreign currency rates,

or commodities is not permitted.

Interest Rate Risk

We are exposed to the impact of interest rate changes on cash, cash equivalents, noncontributory defined benefit pension plans, and debt obligations. The

impact on cash and short-term investments held at December 27, 2014 from a hypothetical 10% decrease in interest rates would be a decrease in interest

income of less than $1 million.

51