OfficeMax 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

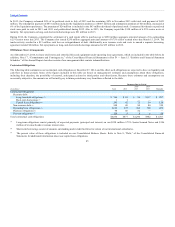

The Company assumed obligations under the OfficeMax U.S. pension plans. In 2004, the plans were closed to new entrants and the benefits of eligible

participants frozen. However, the plans were and continue to be in a net underfunded liability position. The Company makes contributions to the plans in

amounts that are within the limits of deductibility under current tax regulations and not less than the minimum required by law. During 2014, the Company

contributed $43 million to these plans. The passage of new legislation in the Highway and Transportation Funding Act (HATFA) of 2014 reduced the

required contributions to underfunded plans beginning retroactively with the 2013 plan year. The funding relief provided by HATFA will also reduce

required contributions to the pension plans for the next several years. The Company now anticipates contributing $9 million and $2 million to these plans in

2015 and 2016, respectively. The amounts funded are presented as Operating activity outflows in the Consolidated Statement of Cash Flows.

We have entered into the Staples Merger Agreement with Staples and have agreed to pay a fee of $185 million to Staples if the Staples Merger Agreement is

terminated under any of the following circumstances:

• the Company’s Board makes a change in recommendation;

• the Company terminates, at any time prior to obtaining approval of the Staples Acquisition from its stockholders, for the purpose of entering into an

agreement for a “superior proposal”; or

• the Staples Acquisition is not consummated by November 4, 2015 (or, February 4, 2016, if extended as permitted in the Staples Merger Agreement) or the

Company’s stockholders fail to adopt the Merger Agreement and to approve the Staples Acquisition, in each case, only if (i) a third party has made an

acquisition proposal before the Company’s meeting of stockholders to vote on the Staples Acquisition and (ii) within 12 months of the termination of the

Staples Merger Agreement, the Company enters into an alternative transaction.

In addition, whether or not the Staples Acquisition is completed, the uncertainty related to the proposed Staples Acquisition could adversely impact our

business through several factors, including, but not limited to: (i) our current clients may experience uncertainty associated with the Staples Acquisition and

may attempt to negotiate changes in existing business relationships or consider entering into business relationships with parties other than us; (ii) we may

face additional challenges in competing for new and renewal business; and (iii) vendors or suppliers may seek to modify or terminate their business

relationships with us.

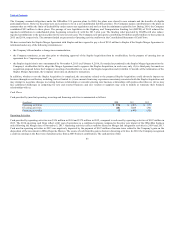

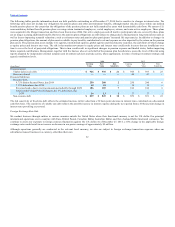

Cash Flows

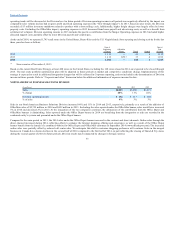

Cash provided by (used in) operating, investing and financing activities is summarized as follows:

(In millions) 2013 2012

Operating activities $ (107) $ 179

Investing activities 1,028 (30)

Financing activities (640) (55)

Operating Activities

Cash provided by operating activities was $156 million in 2014 and $179 million in 2012, compared to cash used by operating activities of $107 million in

2013. The 2014 operating cash flows reflect a full year of operations as a combined company compared to the prior year impact of the OfficeMax business

only following the Merger date of November 5, 2013. Operating activities reflect outflows related to Merger and integration activities in 2014 and 2013.

Cash used in operating activities in 2013 was negatively impacted by the payment of $147 million of income taxes related to the Company’s gain on the

disposition of the investment in Office Depot de Mexico. The source of cash from this gain is shown in Investing activities. In 2012, the Company recognized

a credit in earnings as the Recovery of purchase price from a 2003 business combination. The cash portion of this

43