OfficeMax 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In 2013, the Company redeemed 50% of its preferred stock in July of 2013 and the remaining 50% in November 2013 with total cash payment of $431

million. The redemption payment of $431 million includes the liquidation preference of $407 million and redemption premium of $24 million, measured at

6% of the liquidation preference. The premium of $24 million is included in the $63 million dividend of preferred stock. Contractual dividends on preferred

stock were paid in cash in 2013 and 2011 and paid-in-kind during 2012. Also in 2013, the Company repaid the $150 million of 6.25% senior notes at

maturity. Net repayments on long- and short-term borrowings were $21 million in 2013.

During 2012, the Company completed the settlement of a cash tender offer to purchase up to $250 million aggregate principal amount of its outstanding

6.25% senior notes due 2013. The Company also issued $250 million aggregate principal amount of 9.75% senior secured notes due March 15, 2019. The

tender activity resulted in a $13 million cash loss on extinguishment of debt. Additionally, new issuance costs and costs to amend a separate borrowing

agreement totaled $8 million. Net repayments on long- and short-term borrowings amounted to $35 million in 2012.

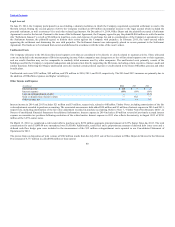

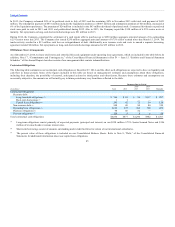

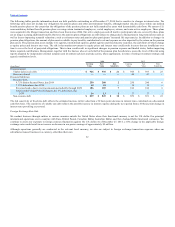

As of December 27, 2014, we lease retail stores and other facilities and equipment under operating lease agreements, which are included in the table below. In

addition, Note 17, “Commitments and Contingencies,” of the Consolidated Financial Statements in Part IV — Item 15. “Exhibits and Financial Statement

Schedules” of this Annual Report describes certain of our arrangements that contain indemnifications.

The following table summarizes our contractual cash obligations at December 27, 2014, and the effect such obligations are expected to have on liquidity and

cash flow in future periods. Some of the figures included in this table are based on management’s estimates and assumptions about these obligations,

including their duration, the possibility of renewal, anticipated actions by third parties and other factors. Because these estimates and assumptions are

necessarily subjective, the amounts we will actually pay in future periods may vary from those reflected in the table.

(In millions) Total 2015

2016-

2017

2018-

2019 Thereafter

Contractual Obligations

Recourse debt:

Long-term debt obligations $ 744 $ 42 $ 98 $317 $ 287

Short-term borrowings 1 1 — — —

Capital lease obligations 293 42 72 59 120

Non-recourse debt 948 40 80 80 748

Operating lease obligations 2,653 697 982 520 454

Purchase obligations 98 46 52 — —

Pension obligations 119 9 6 6 98

Total contractual cash obligations $4,856 $877 $1,290 $982 $ 1,707

Long-term obligations consist primarily of expected payments (principal and interest) on our $250 million 9.75% Senior Secured Notes and $186

million of revenue bonds at various interest rates.

Short-term borrowings consist of amounts outstanding under credit facilities for certain of our international subsidiaries.

The present value of these obligations is included on our Consolidated Balance Sheets. Refer to Note 8, “Debt,” of the Consolidated Financial

Statements for additional information about our capital lease obligations.

45

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(1)

(2)

(3)