OfficeMax 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

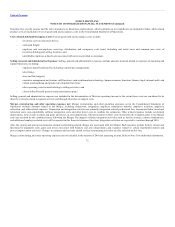

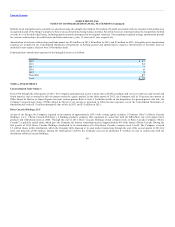

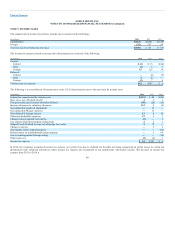

Estimated future amortization expense related to capitalized software at December 27, 2014 is as follows:

(In millions)

2015 $74

2016 42

2017 19

2018 9

2019 4

Thereafter —

The weighted average remaining amortization period for capitalized software is 2.8 years.

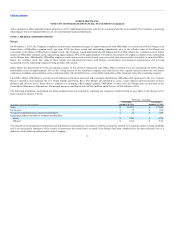

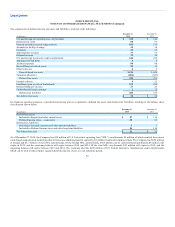

Other assets held for sale

Certain facilities identified for closure through integration and other activities have been accounted for as assets held for sale. As of December 27, 2014, these

assets amount to $31 million and are presented in Prepaid expenses and other current assets in the Consolidated Balance Sheet. Any gain on these

dispositions, which are expected to be completed within one year, will be recognized at the Corporate level and included when realized in Merger,

restructuring and other operating expenses, net in the Consolidated Statement of Operations.

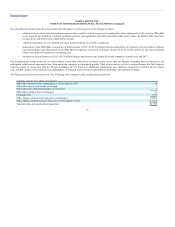

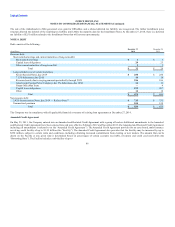

The components of goodwill by segment are provided in the following table:

(In millions)

Goodwill $ 2 $ 368 $ 909 — $ 1,279

Accumulated impairment losses (2) (349) (863) — (1,214)

Foreign currency rate impact — — (1) — (1)

Balance as of December 29, 2012 $ — $ 19 $ 45 — $ 64

Impairment loss — — (44) — (44)

Additions — 2 — 377 379

Foreign currency rate impact — — (1) — (1)

Balance as of December 28, 2013 $ — $ 21 $ — 377 $ 398

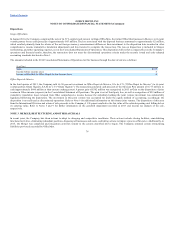

Goodwill additions included in Corporate in 2013 relate to the Merger. The allocation of the Merger consideration to the reporting units was completed in

the third quarter of 2014. As the Company finalized the purchase price allocation in 2014, certain preliminary values were adjusted as additional information

became available. Initial amounts allocated to certain property and equipment accounts decreased by $16 million and tax

82