OfficeMax 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

reassessment of the use of an international private brand trade name. The 2013 impairment charge includes a $44 million goodwill impairment triggered

by the sale of our interest in Office Depot de Mexico. Both 2014 and 2013 include charges related to underperforming stores in North America.

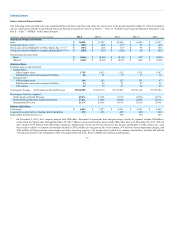

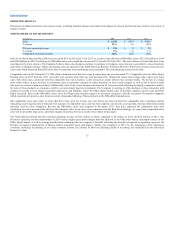

• We incurred $403 million and $201 million of Merger, restructuring, and other operating expenses, net in 2014 and 2013, respectively. In 2014, this line

item includes $332 million of expenses related to the Merger transaction and integration activities, including store closure costs incurred to date, and $71

million of restructuring and other operating expenses. Additional integration and restructuring expenses are expected to be incurred in 2015 and 2016.

• We recorded an $81 million incremental legal accrual during 2014 relating to allegations of certain pricing practices under agreements that were in place

between 2001 and January 1, 2011. In December 2014, the Company and plaintiffs executed a Settlement Agreement to resolve this litigation. In February

2015, the court entered orders approving the settlement and dismissing the case with prejudice. The Settlement Amount was subsequently placed in

escrow pursuant to the Settlement Agreement. The funds are to be released from escrow and disbursed in accordance with the terms of the court’s orders.

• In August 2014, we completed the sale of our interest in Grupo OfficeMax to our joint venture partner, for net cash proceeds of $43 million. The loss

associated with this disposed Mexican business amounted to approximately $2 million, which resulted primarily from the release of the net foreign

currency remeasurement differences from investment to the disposition date recorded in other comprehensive income (cumulative translation adjustment)

and fees incurred to complete the transaction.

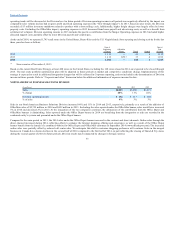

• Interest income increased in 2014 primarily due to the impact of OfficeMax Timber Notes income. Interest expenses in 2014 increased when compared to

2013, mainly due to interest expense related to OfficeMax recourse and non-recourse debt, which was partially offset by a reversal in 2014 of previously

accrued interest expense on uncertain tax positions and the August 2013 maturity of $150 million of the 6.25% senior notes.

• The effective tax rate for 2014 was negative 4%, reflecting the impact of valuation allowances limiting recognition of deferred tax assets. Because of the

valuation allowances and changes in the mix of earnings among jurisdictions, the Company continues to experience significant effective tax rate

volatility within the year and across years.

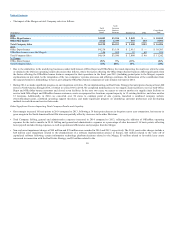

• The loss per share was $(0.66) in 2014 compared to $(0.29) in 2013. The 2014 loss per share was negatively impacted by Merger expenses and

restructuring charges, asset impairments and the legal accrual. The 2014 weighted average shares include a twelve month impact from the outstanding

shares issued in connection with the Merger, compared to the 2013 impact for the period from the Merger date through year end. The 2013 loss per share

was positively impacted by the gain on joint venture sale.

• At the end of 2014, we had approximately $1.1 billion in cash and cash equivalents and $1.1 billion available on our asset based credit facility. Cash flow

from operating activities was a source of $156 million for 2014.

31