OfficeMax 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

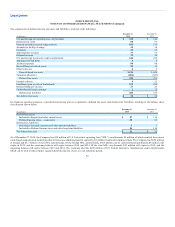

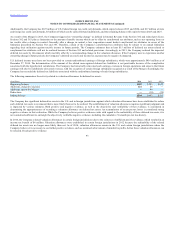

account adjustments were $1 million. Goodwill of $24 million was allocated to the Grupo OfficeMax business and was removed following the August 2014

sale of that business.

As a result of the disposition of its investment in Office Depot de Mexico and the associated return of cash to the U.S. parent, in the third quarter of 2013, the

carrying value of the related reporting unit exceeded its fair value. Because the investment was accounted for under the equity method, no goodwill was

allocated to the gain on disposition of joint venture calculation. However, concurrent with the sale and gain recognition, a goodwill impairment charge of

$44 million was recognized and is reported on the Asset impairments line in the Consolidated Statements of Operations. Refer to Note 16 for additional

discussion of goodwill valuation considerations and annual impairment testing.

Definite-lived intangible assets are reviewed periodically to determine whether events and circumstances indicate the carrying amount may not be

recoverable or the remaining period of amortization should be revised. In connection with implementing the Real Estate Strategy in 2014, the Company

recognized impairment charges associated with favorable leases related to identified closing locations totaling $5 million. In 2012, the Company re-

evaluated the remaining balances of certain amortizing intangible assets associated with a 2011 acquisition in Sweden. An impairment charge of $14 million

was recognized. These impairment charges are presented in Asset impairments in the Consolidated Statements of Operations. Refer to Note 16 for additional

information on fair value measurement and Real Estate Strategy.

During 2014, the Company reassessed its use of a private brand trade name used internationally that previously had been assigned an indefinite life. The

expected change in profile and life of this brand, along with assigning an estimated life of three years, resulted in an impairment charge of $5 million which is

reported in Asset impairments in the Consolidated Statement of Operations. At December 28, 2013, the carrying value of this indefinite-lived intangible asset

was $6 million.

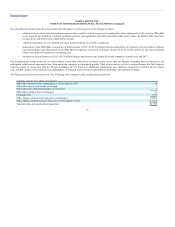

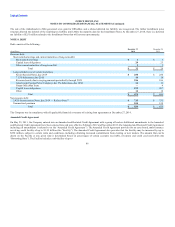

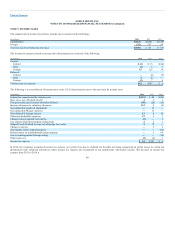

Definite-lived intangible assets, which are included in Other intangible assets in the Consolidated Balance Sheets, are as follows:

(In millions)

Customer relationships

Favorable leases

Trade names

Total

December 28, 2013

(In millions)

Gross

Carrying Value

Accumulated

Amortization

Net

Carrying Value

Customer relationships $ 74 $ (20) $ 54

Favorable leases 44 — 44

Trade names 10 (1) 9

Total $ 128 $ (21) $ 107

83