OfficeMax 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

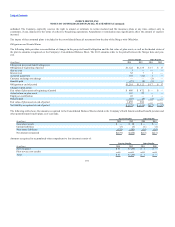

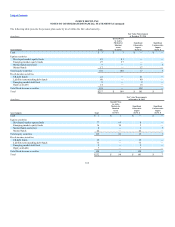

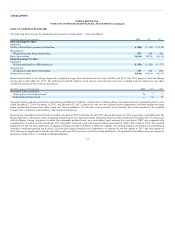

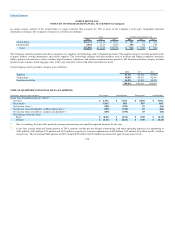

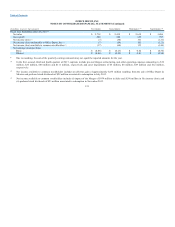

The following table presents the calculation of net loss per common share — basic and diluted:

(In millions, except per share amounts) 2013 2012

Numerator:

Net loss attributable to common stockholders $ (93) $ (110)

Denominator:

Weighted-average shares outstanding 318 280

Basic loss per share $ (0.29) $ (0.39)

Numerator:

Net loss attributable to Office Depot, Inc. $ (20) $ (77)

Denominator:

Weighted-average shares outstanding 318 280

Diluted loss per share $(0.29) $ (0.39)

Shares issued related to the Merger impact the weighted average share calculation for the years of 2014 and 2013. The 2013 impact is from the Merger

closing date to December 28, 2013. The following potentially dilutive stock options and restricted stock were excluded from the diluted loss per share

calculation because of the net loss in the periods.

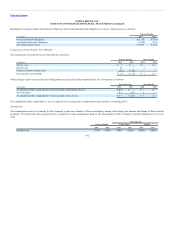

(In millions, except per share amounts) 2013 2012

Potentially dilutive securities:

Stock options and restricted stock 7 5

Redeemable preferred stock 56 78

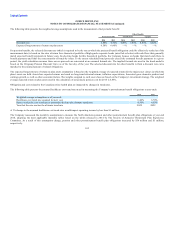

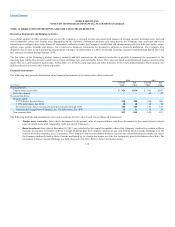

Awards of options and nonvested shares representing an additional 9 million, 6 million and 15 million shares of common stock were outstanding for the years

ended December 27, 2014, December 28, 2013, and December 29, 2012, respectively, but were not included in the computation of diluted weighted-average

shares outstanding because their effect would have been antidilutive. For the three years presented, no tax benefits have been assumed in the weighted

average share calculation in jurisdictions with valuation allowances.

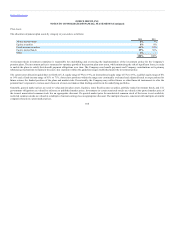

Shares of the redeemable preferred stock were fully redeemed in 2013. Following the July 2013 shareholder approval of the transactions contemplated by the

Merger Agreement, 50 percent of the outstanding preferred stock was redeemed and the remaining 50 percent was redeemed in November 2013 in connection

with the Merger closing. In periods in which the redeemable preferred stock were outstanding, basic earnings (loss) per share (“EPS”) was computed after

consideration of preferred stock dividends. The redeemable preferred stock had equal dividend participation rights with common stock that required

application of the two-class method for computing earnings per share. In periods of sufficient earnings, this method assumes an allocation of undistributed

earnings to both participating stock classes. The two-class method impacted the computation of earnings for the first quarter of 2012 and third quarter of

2013, but was not applicable to the full year 2012 or full year 2013 because it would have been antidilutive. The preferred stockholders were not required to

fund losses. Refer to Note 11 for further redemption details.

111