OfficeMax 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

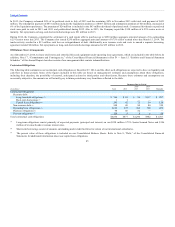

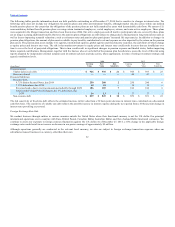

The following tables provide information about our debt portfolio outstanding as of December 27, 2014 that is sensitive to changes in interest rates. The

following table does not include our obligations for pension plans and other postretirement benefits, although market risk also arises within our defined

benefit pension plans to the extent that the obligations of the pension plans are not fully matched by assets with determinable cash flows. We sponsor U.S.

noncontributory defined benefit pension plans covering certain terminated employees, vested employees, retirees, and some active employees. These plans

were acquired in the Merger transaction and have been frozen since 2004. Our active employees and all inactive participants who are covered by these plans

are no longer accruing additional benefits. However, the pension plans obligations are still subject to change due to fluctuations in long-term interest rates as

well as factors impacting actuarial valuations, such as retirement rates and pension plan participants’ increased life expectancies. In addition to changes in

pension plan obligations, the amount of plan assets available to pay benefits, contribution levels and expense are also impacted by the return on the pension

plan assets. The pension plan assets include U.S. equities, international equities, global equities and fixed-income securities, the cash flows of which change

as equity prices and interest rates vary. The risk is that market movements in equity prices and interest rates could result in assets that are insufficient over

time to cover the level of projected obligations. This in turn could result in significant changes in pension expense and funded status, further impacting

future required contributions. Management, together with the trustees who act on behalf of the pension plan beneficiaries, assess the level of this risk using

reports prepared by independent external actuaries and investment advisors and take action, where appropriate, in terms of setting investment strategy and

agreed contribution levels.

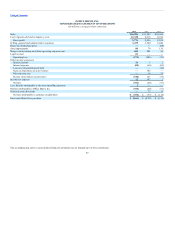

2013

(In millions)

Carrying

Value

Fair

Value

Risk

Sensitivity

Financial assets:

Timber notes receivable $ 945 $ 933 $ 25

Boise investment 46 47 —

Financial liabilities:

Recourse debt:

9.75% Senior Secured Notes, due 2019 250 290 6

7.35% debentures, due 2016 18 19 —

Revenue bonds, due in varying amounts periodically through 2029 186 186 6

American & Foreign Power Company, Inc. 5% debentures, due

2030 13 13 1

Non-recourse debt $ 859 $ 851 $ 22

The risk sensitivity of fixed rate debt reflects the estimated increase in fair value from a 50 basis point decrease in interest rates, calculated on a discounted

cash flow basis. The sensitivity of variable rate debt reflects the possible increase in interest expense during the next period from a 50 basis point change in

interest rates prevailing at year-end.

Foreign Exchange Rate Risk

We conduct business through entities in various countries outside the United States where their functional currency is not the U.S. dollar. Our principal

international operations are in countries with Euro, British Pound, Canadian Dollar, Australian Dollar, and New Zealand Dollar functional currencies. We

continue to assess our exposure to foreign currency fluctuation against the U.S. dollar. As of December 27, 2014, a 10% change in the applicable foreign

exchange rates would result in an increase or decrease in our pretax earnings of approximately $5 million.

Although operations generally are conducted in the relevant local currency, we also are subject to foreign exchange transaction exposure when our

subsidiaries transact business in a currency other than their own

52