OfficeMax 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

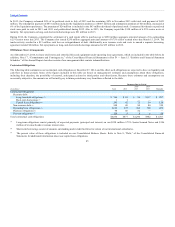

Goodwill and other intangible assets — The Merger-related purchase price allocation was completed during 2014 and goodwill was allocated to the

reporting units. Because of the addition to goodwill, the Company elected to perform its 2014 impairment analysis using a quantitative approach of

discounted cash flow analysis supplemented with market comparison data, where available. The estimated fair value of each reporting unit exceeded its

carrying value at the test date, which was the first day of the third quarter. The reporting unit of Australia and New Zealand, which was not combined with any

existing Office Depot businesses, had an estimated fair value approximately 10% above its carrying value. Goodwill in that reporting unit is $15 million. The

estimated fair value of this reporting unit includes projected cash outflows related to certain restructuring activities. Should these restructuring activities not

result in the anticipated future period benefits, or if there is a downturn in performance, a potential future goodwill impairment could result. However, the

Company believes, based on these projections, that there are no current indicators of impairment in this reporting unit. The estimated fair values of the other

reporting units, which were combined with existing Office Depot businesses, were substantially in excess of their carrying values.

Unless conditions suggest an asset’s value may not be recoverable, indefinite-lived intangible assets are tested annually for impairment and definite-lived

intangible assets are a reviewed annually to ensure the remaining useful lives are appropriate. A change in the anticipated value of an intangible asset may

result in its impairment. During 2014, the Company changed its planned use of a private brand trade name used internationally from an indefinite life to a

shorter period and at a lower profile. This change in planned usage resulted in an impairment charge of $5 million.

Other intangible assets include favorable lease assets, trade names and assets associated with customer relationships. The favorable lease assets were

established in the Merger for lease rental rates below current market rates for comparable properties and assumed renewal of all available options. The

favorable lease asset is being amortized over the same period. Should the Company decide to close the facility prior to the full contemplated term, the

recoverability will be subject to then-current fair value of the lease right. During 2014, the Company recognized $5 million of impairment of favorable lease

assets because of closure activity. Approximately $12 million, or 50% of the favorable lease asset balance related to stores in the U.S. at December 27, 2014,

is associated with 13 locations. The remainder in the U.S. is for lower amounts distributed across many locations. Should the Company close locations in the

future, or assumed future sublease rates decline, some amount of the favorable lease asset value may be impaired.

The most significant remaining intangible asset at December 27, 2014 relates to customer relationships in the North America Contract channel. If the

Company experiences an unanticipated decline in sales associated with these customers, the remaining useful life will be reassessed and either acceleration of

amortization or impairment could result.

Closed store accruals — During 2014, the Company developed the Real Estate Strategy that included closing of approximately 400 retail stores in the

United States through 2016. The locations identified for possible closure considered market position, sales trends, remaining lease term, the proximity of

other Company locations, likely sales transfer rates and other factors. The specific identity of stores to close will be influenced by real estate and marketplace

conditions. At the point of closure, we recognize a liability for the remaining costs related to the property, reduced by an estimate of any sublease income.

The calculation of this liability requires us to make assumptions and to apply judgment regarding the remaining term of the lease (including vacancy period),

anticipated sublease income, and costs associated with vacating the premises. Lease commitments with no economic benefit to the Company are discounted

at the credit-adjusted discount rate at the time of each location closure. With assistance from independent third parties to assess market conditions, we

periodically review these judgments and estimates and adjust the liability accordingly. Future fluctuations in the economy and the market demand for

commercial properties could result in material changes in this liability. Costs associated with facility closures that are related to Merger and restructuring

activities are and, in future periods will be, presented in Merger, restructuring and other operating activities, net in our Consolidated Statements of

Operations. Costs

49