OfficeMax 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

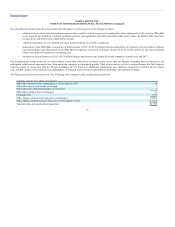

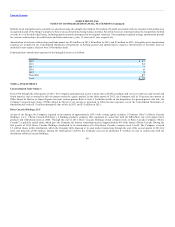

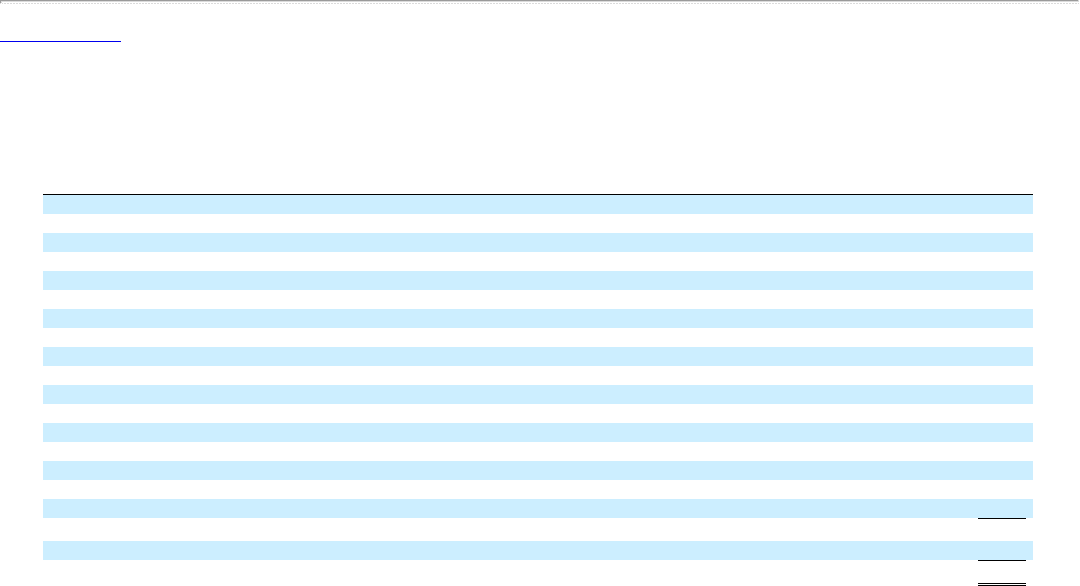

The following table summarizes the allocation of the consideration to the assets and liabilities at November 5, 2013, as adjusted through the measurement

period.

(In millions)

Cash and cash equivalents $ 460

Receivables 521

Inventories 766

Prepaid expenses and other current assets 106

Property and equipment 521

Favorable leases 44

Definite-lived intangible assets, primarily customer relationships and trade names 57

Investment in Boise Cascade Holdings 80

Timber notes receivable 948

Other noncurrent assets 51

Accounts payable (527)

Other current liabilities (471)

Unfavorable leases (54)

Non-recourse debt (863)

Recourse debt (228)

Pension and other postretirement obligations (180)

Deferred income taxes and other long-term liabilities and Noncontrolling interest (230)

Total identifiable net assets 1,001

Goodwill 394

Total $1,395

Includes accrued expenses and other current liabilities and income taxes payable

Includes $24 million of goodwill allocated to Grupo OfficeMax that was sold in 2014

Receivables are recorded at fair value which represents the amount expected to be collected. Contractual amounts are higher by $14 million. Receivables

include trade receivables of approximately $343 million and vendor and other receivables of $178 million.

The goodwill attributable to the Merger will not be amortizable or deductible for tax purposes. Goodwill is considered to represent the value associated with

the workforce and synergies the two companies anticipate realizing as a combined company. Refer to Note 5 for further details on goodwill allocation to the

reporting units.

Noncontrolling interest relating to the joint venture in Mexico was valued, using the same fair value measurement methodologies applied to all assets

acquired and liabilities assumed in the Merger and a fair value estimate based on market multiples. The disposition of the joint venture in 2014 resulted in no

gain or loss other than transaction costs and foreign currency impacts.

Merger and integration costs are not included as components of consideration transferred but are accounted for as expenses in the period in which the costs

are incurred. Transaction-related expenses are included in the Merger, restructuring, and other operating expenses, net line in the Consolidated Statements of

Operations. Refer to Note 3 for additional information about the costs incurred and Note 9 for discussion of the income tax impacts of the Merger.

77

(a)

(b)

(a)

(b)