OfficeMax 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

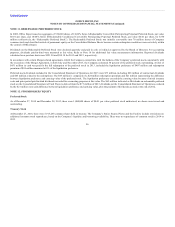

In addition, the Company assumed the share issuance plan formerly related to OfficeMax employee grants, the 2003 OfficeMax Incentive and Performance

Plan (the “2003 Plan”). Eight types of awards may be granted under the 2003 Plan, including stock options, stock appreciation rights, restricted stock,

restricted stock units, performance units, performance shares, annual incentive awards and stock bonus awards. Awards granted under this plan are of Office

Depot, Inc. common stock.

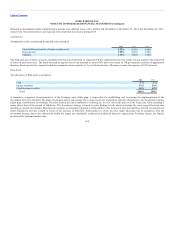

Each option to purchase OfficeMax common stock outstanding immediately prior to the effective time of the Merger was converted into an option to

purchase Office Depot common stock, on the same terms and conditions adjusted by the 2.69 exchange ratio provided for in the Merger Agreement. The fair

value of those options was measured using an option pricing model with the following assumptions: risk-free rate 0.42%; expected life 2.34; dividend yield

of zero; expected volatility 52.18% and forfeiture rate of 5%.

Similarly, each previously-existing OfficeMax restricted stock and restricted stock unit outstanding immediately prior to the effective time of the Merger was

converted into an Office Depot restricted stock or restricted stock unit, as appropriate, at the 2.69 exchange ratio. The fair value of these awards was allocated

to consideration and unearned compensation, based on the past and future service conditions. The assumed awards related to the Merger have been

identified, as applicable, in the tables that follow.

The Company’s stock option exercise price for each grant of a stock option shall not be less than 100% of the fair market value of a share of common stock

on the date the option is granted. Options granted under the Plan and the 2003 Plan have vesting periods ranging from one to five years and from one to three

years after the date of grant, respectively, provided that the individual is continuously employed with the Company. Following the date of grant, all options

granted under the Plan and the 2003 Plan expire no more than ten years and seven years, respectively. No stock options were granted in 2014.

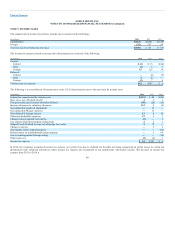

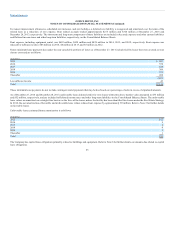

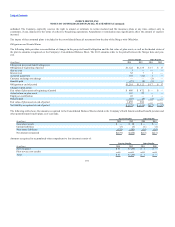

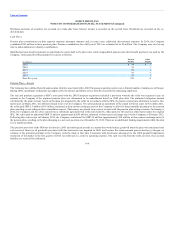

A summary of the activity in the stock option plans for the last three years is presented below.

2013 2012

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding at beginning of year 12,578,071 $ 5.25 19,059,176 $ 6.90

Granted 2,003,000 5.24 82,000 3.22

Assumed — Merger 13,142,351 3.62 — —

Forfeited (2,072,560) 8.83 (4,512,372) 14.51

Exercised (2,948,328) 1.40 (2,050,733) 0.88

Outstanding at end of year 22,702,534 $ 4.48 12,578,071 $ 5.25

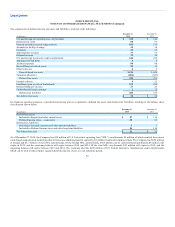

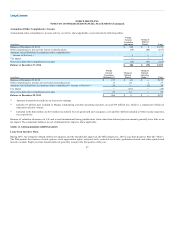

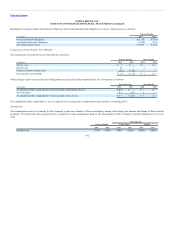

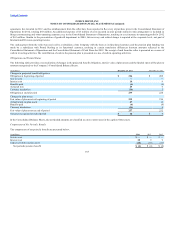

The weighted-average grant date fair values of options granted during 2013 and 2012 were $3.00 and $1.86, respectively, using the following weighted

average assumptions for grants:

• Risk-free interest rates of 1.69% for 2013 and 0.94% for 2012

• Expected lives of six years for 2013 and 4.5 years for 2012

• A dividend yield of zero for both years

• Expected volatility ranging from 61% to 69% for 2013 and 72% to 74% for 2012

• Forfeitures are anticipated at 5% and are adjusted for actual experience over the vesting period

98