OfficeMax 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The sale of the timberlands in 2004 generated a tax gain for OfficeMax and a related deferred tax liability was recognized. The timber installment notes

structure allowed the deferral of the resulting tax liability until 2020, the maturity date for the Installment Notes. At December 27, 2014, there is a deferred

tax liability of $251 million related to the Installment Notes that will reverse upon maturity.

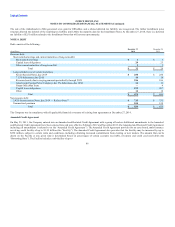

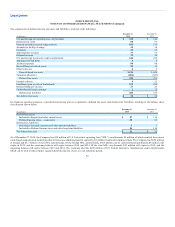

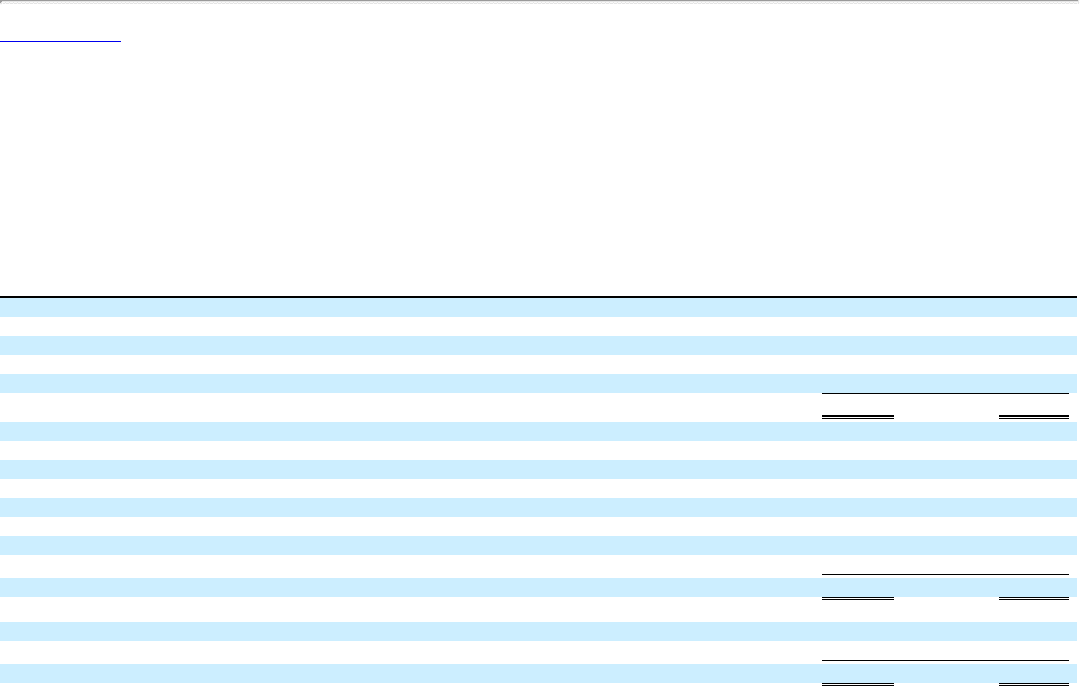

Debt consists of the following:

(In millions)

December 28,

2013

Recourse debt:

Short-term borrowings and current maturities of long-term debt:

Short-term borrowings $ 3

Capital lease obligations 23

Other current maturities of long-term debt 3

Total $ 29

Long-term debt, net of current maturities:

Senior Secured Notes, due 2019 $ 250

7.35% debentures, due 2016 18

Revenue bonds, due in varying amounts periodically through 2029 186

American & Foreign Power Company, Inc. 5% debentures, due 2030 13

Grupo OfficeMax loans 4

Capital lease obligations 207

Other 18

Total $ 696

Non-recourse debt:

5.42% Securitization Notes, due 2019 — Refer to Note 7 $ 735

Unamortized premium 124

Total $ 859

The Company was in compliance with all applicable financial covenants of existing loan agreements at December 27, 2014.

On May 25, 2011, the Company entered into an Amended and Restated Credit Agreement with a group of lenders. Additional amendments to the Amended

and Restated Credit Agreement have been entered into and were effective February 2012 and November 2013 (the Amended and Restated Credit Agreement

including all amendments is referred to as the “Amended Credit Agreement”). The Amended Credit Agreement provides for an asset based, multi-currency

revolving credit facility of up to $1.25 billion (the “Facility”). The Amended Credit Agreement also provides that the Facility may be increased by up to

$250 million, subject to certain terms and conditions, including obtaining increased commitments from existing or new lenders. The amount that can be

drawn on the Facility at any given time is determined based on percentages of certain accounts receivable, inventory and credit card receivables (the

“Borrowing Base”). The Facility includes a sub-facility of up to

86