OfficeMax 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

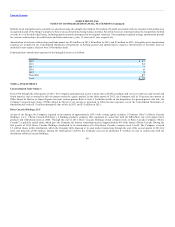

Definite-lived intangible assets generally are amortized using the straight-line method. The pattern of benefit associated with one customer relationship asset

recognized as part of the Merger warranted a three-year accelerated declining balance method. Favorable leases are amortized using the straight-line method

over the lives of the individual leases, including option renewals anticipated in the original valuation. The remaining weighted average amortization periods

for customer relationships, favorable leases and trade names are 6 years, 15 years, and 1 year, respectively.

Amortization of customer relationships and trade names was $18 million in 2014, $4 million in 2013, and $5 million in 2012. Intangible assets amortization

expenses are included in the Consolidated Statements of Operations in Selling, general and administrative expenses. Amortization of favorable leases is

included in rent expense. Refer to Note 10 for further detail.

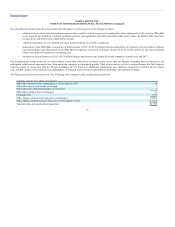

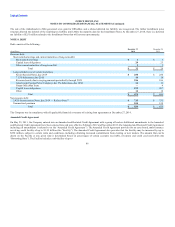

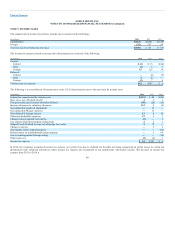

Estimated future amortization expense for the intangible assets is as follows:

(In millions)

2015

2016

2017

2018

2019

Thereafter

Total

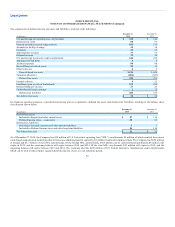

From 1994 through the third quarter of 2013, the Company participated in a joint venture that sold office products and services in Mexico and Central and

South America, and accounted for this investment under the equity method. In the third quarter of 2013, the Company sold its 50 percent investment in

Office Depot de Mexico to Grupo Gigante, the joint venture partner. Refer to Note 2 for further details on the disposition. For periods prior to the sale, the

Company’s proportionate share of Office Depot de Mexico’s net income is presented in Other income (expense), net in the Consolidated Statements of

Operations and totaled $13 million through the date of sale in 2013 and $32 million in 2012.

As part of the Merger, the Company acquired an investment of approximately 20% of the voting equity securities (“Common Units”) of Boise Cascade

Holdings, L.L.C. (“Boise Cascade Holdings”), a building products company that originated in connection with the OfficeMax sale of its paper, forest

products and timberland assets in 2004. Through the end of 2013, Boise Cascade Holdings owned common stock of Boise Cascade Company (“Boise

Cascade”), a publicly traded entity, which gave the Company the indirect ownership interest of approximately 4% of the shares of Boise Cascade. During the

first quarter of 2014, Boise Cascade Holdings distributed to its shareholders all of the Boise Cascade common stock it held. The Company received

1.6 million shares in this distribution, which the Company fully disposed of in open market transactions through the end of the second quarter of 2014 for

total cash proceeds of $43 million. During the third quarter of 2014, the Company received an additional $1 million of cash in conjunction with the

dissolution of Boise Cascade Holdings.

84