OfficeMax 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

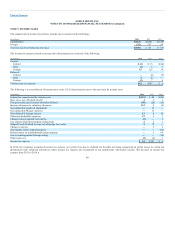

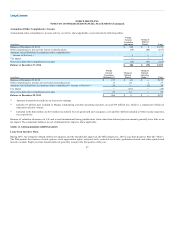

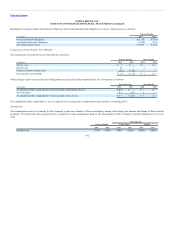

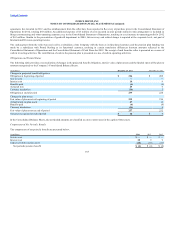

The following table summarizes information about options outstanding and exercisable at December 27, 2014.

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number

Outstanding

Weighted Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise

Price

Number

Exercisable

Weighted Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise

Price

$0.83 $3.00 2,715,238 2.74 $ 1.42 2,220,878 2.43 $ 1.33

3.01 5.12 1,456,050 2.92 4.37 1,399,176 2.90 4.39

5.13 301,034 2.45 5.13 301,034 2.45 5.13

5.14 8.00 3,331,826 6.34 5.73 1,998,492 4.64 6.05

8.01 11.27 798,478 1.05 10.19 798,478 1.05 10.19

$0.83 $11.27 8,602,626 4.00 $ 4.53 6,718,058 3.02 $ 4.60

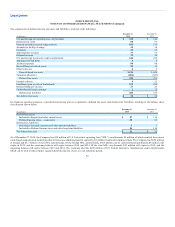

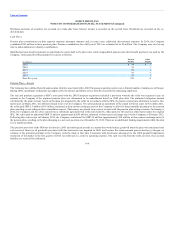

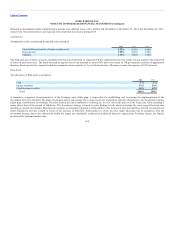

The intrinsic value of options exercised in 2014, 2013, and 2012, was $27 million, $10 million, and $4 million, respectively. The aggregate intrinsic value of

options outstanding and exercisable at December 27, 2014 were $38 million and $30 million, respectively.

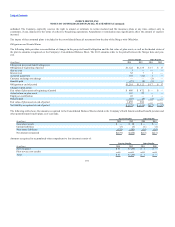

As of December 27, 2014, there was approximately $4.1 million of total stock-based compensation expense that has not yet been recognized relating to non-

vested awards granted under option plans. This expense is expected to be recognized over a weighted-average period of approximately 1.8 years. The

Company estimates that all of the 1.9 million unvested options will vest. The number of exercisable options was 6.7 million shares of common stock at

December 27, 2014 and 16.9 million shares of common stock at December 28, 2013.

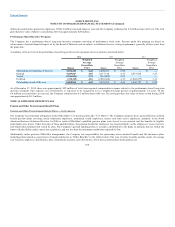

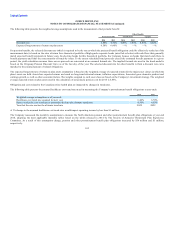

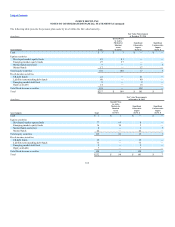

In 2014, the Company granted 5.8 million shares of restricted stock and restricted stock units to eligible employees. In addition, 0.3 million shares were

granted to the Board of Directors as part of their annual compensation and vested immediately on the grant date with distribution to occur following their

separation from service with the Company. Restricted stock grants to Company employees typically vest annually over a three-year service period. A

summary of the status of the Company’s nonvested shares and changes during 2014, 2013, and 2012 is presented below.

2013 2012

Shares

Weighted

Average

Grant-Date

Price Shares

Weighted

Average

Grant-Date

Price

Outstanding at beginning of year 5,459,900 $ 3.52 2,612,876 $ 3.96

Granted 4,884,848 4.54 4,018,253 3.26

Assumed — Merger 6,426,968 3.46 — —

Vested (5,788,992) 4.49 (695,751) 3.45

Forfeited (775,178) 4.01 (475,478) 3.79

Outstanding at end of year 10,207,546 $ 4.76 5,459,900 $ 3.52

As of December 27, 2014, there was approximately $27 million of total unrecognized compensation cost related to nonvested restricted stock. This expense,

net of forfeitures, is expected to be recognized over a weighted-average period of approximately 2 years. Total outstanding shares of 10.7 million include

1.7 million granted to members of the Board of Directors that have vested but will not be issued until separation from service and nine

99