OfficeMax 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

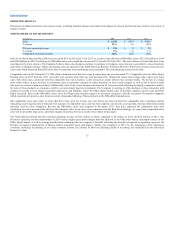

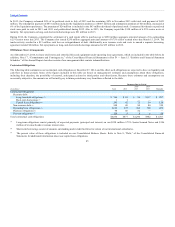

(In millions) 2013

Sales $ 155 $ 40

Other operating income (loss) $ 8 $ (2)

With the Merger, we acquired the OfficeMax joint venture business operating in Mexico, Grupo OfficeMax. In August 2014, we completed the sale of our

interest in this business to our joint venture partner. In the second quarter of 2014, due to the pending sale, the integration of this business into the

International Division was suspended and has since been managed and reported independently of the Company’s other international businesses. Prior period

segment information has been recast to reflect this change in the reporting structure.

Since the Company controlled the joint venture, the total Grupo OfficeMax results through the date of the sale are included in the Consolidated Statement of

Operations, with an apportionment of the period results to the noncontrolling interest based on their ownership percentage. The release of cumulative

translation adjustments and transaction fees are included in Merger, restructuring and other operating expenses, net in the Consolidated Statement of

Operations.

The Company adopted the new accounting standard on discontinued operations in the second quarter of 2014. While this is a disposal of all of our

operations in Mexico, it is not considered to have a major effect on our operations or financial results and, accordingly, it is not presented as discontinued

operations.

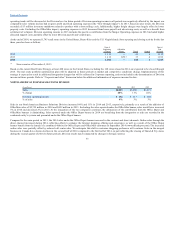

The line items in our Consolidated Statements of Operations impacted by these Corporate activities are presented in the table below, followed by a narrative

discussion of the significant matters. These activities are managed at the Corporate level and, accordingly, are not included in the determination of Division

income for management reporting or external disclosures.

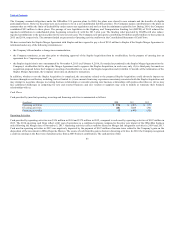

(In millions) 2013 2012

Recovery of purchase price — (68)

Asset impairments 70 139

Merger, restructuring, and other operating expenses, net 201 56

Legal accrual — —

Total charges and credits impact on Operating loss $ 271 $ 127

In addition to these charges and credits, certain Selling, general and administrative expenses are not allocated to the Divisions and are managed at the

Corporate level. Those expenses are addressed in the section “Unallocated Costs” below.

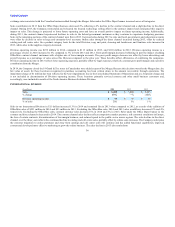

The sale and purchase agreement (“SPA”) associated with the 2003 European acquisition included a provision whereby the seller was required to pay an

amount to the Company if the acquired pension plan was determined to be underfunded based on 2008 plan data. The unfunded obligation amount

calculated by the plan’s actuary based on that data was disputed by the seller. While the matter was still pending, in 2011, the seller paid GBP 5.5 million ($9

million, measured at then-current exchange rates) to the Company to allow for future monthly payments to the pension plan. In January 2012, the Company

and the seller entered into a settlement agreement that settled all claims by either party for this and any other matter under the original SPA. The seller paid an

additional GBP 32.2 million (approximately $50 million, measured at then-current exchange rates) to the Company in February 2012. Following this cash

receipt in February 2012, the Company contributed the GBP

36