OfficeMax 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

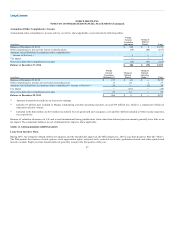

On March 15, 2012, the Company repurchased $250 million aggregate principal amount of its outstanding Senior Notes under a cash tender offer. The total

consideration for each $1,000.00 note surrendered was $1,050.00. Tender fees and a proportionate amount of deferred debt issue costs and a deferred cash

flow hedge gain were included in the measurement of the $12 million extinguishment loss reported in the Consolidated Statement of Operations for 2012.

The cash amounts of the premium paid and tender fees are reflected as financing activities in the Consolidated Statements of Cash Flows. Accrued interest

was paid through the extinguishment date. The remaining $150 million was repaid at par, upon maturity in August 2013.

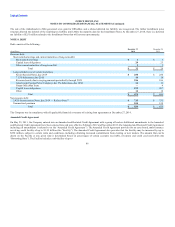

As a result of the Merger, the Company assumed the liability for the amounts in the table above related to the (i) 7.35% debentures, due 2016, (ii) Revenue

bonds, due in varying amounts periodically through 2029, and (iii) American & Foreign Power Company, Inc. 5% debentures, due 2030.

Capital lease obligations primarily relate to buildings and equipment.

The Company had short-term borrowings of $1 million at December 27, 2014 under various local currency credit facilities for international subsidiaries that

had an effective interest rate at the end of the year of approximately 5%. The maximum month end amount occurred in March 2014 at approximately $10

million and the maximum monthly average amount occurred in March 2014 at approximately $6 million. The majority of these short-term borrowings

represent outstanding balances on uncommitted lines of credit, which do not contain financial covenants.

Refer to Note 7 for further information on non-recourse debt.

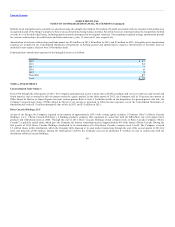

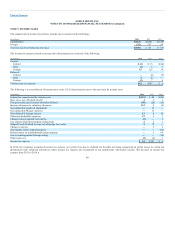

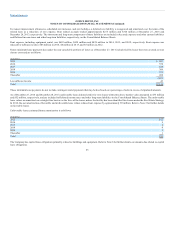

Aggregate annual maturities of recourse debt and capital lease obligations are as follows:

(In millions)

2015

2016

2017

2018

2019

Thereafter

Total

Less amount representing interest on capital leases

Total

Less current portion

Total long-term debt

89