OfficeMax 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

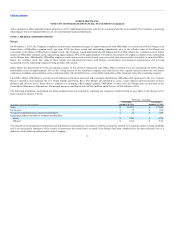

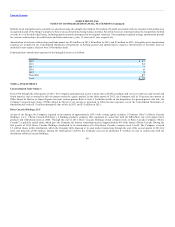

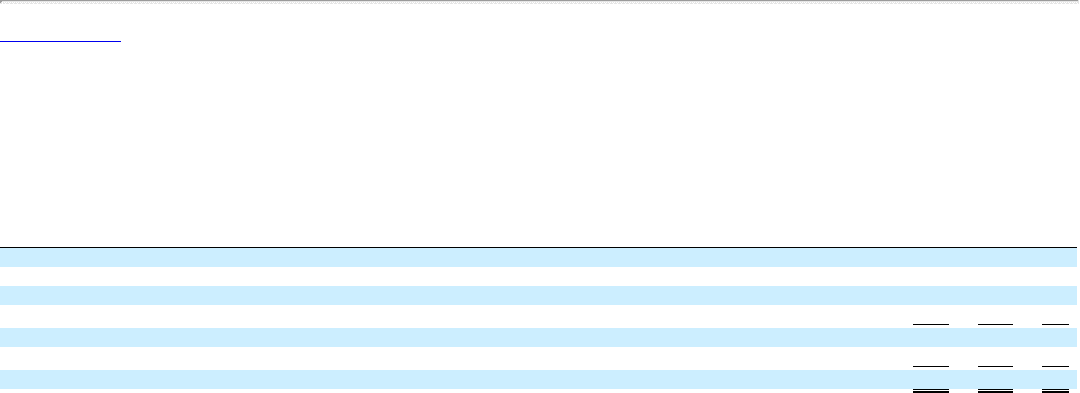

The Company presents Merger, restructuring and other operating expenses, net on a separate line in the Consolidated Statements of Operations to identify

these activities apart from the expenses incurred to sell to and service its customers. These expenses are not included in the determination of Division

operating income. The table below summarizes the major components of Merger, restructuring and other operating expenses, net.

(In millions)

Merger related expenses

Severance, retention, and relocation $148 $ 92 $ —

Transaction and integration 124 80 —

Other related expenses 60 8 —

Total Merger related expenses 332 180 —

Restructuring and certain other expenses 71 21 56

Total Merger, restructuring and other operating expenses, net $403 $201 $56

Severance, retention, and relocation includes expenses incurred by Office Depot in 2013 and by the combined companies since the date of the Merger though

December 27, 2014, and reflects integration throughout the staff functions. Since the second quarter of 2014, the Real Estate Strategy has been sufficiently

developed to provide a basis for estimating termination benefits for certain retail and supply chain closures that are expected to extend through 2016. Such

benefits are being accrued through the anticipated employee full eligibility date. Because the specific identity of retail locations to be closed is subject to

change as the Real Estate Strategy evolves, the Company applied a probability method to estimating the store closure severance accrual. The calculation

considers factors such as the expected timing of store closures, terms of existing severance plans, expected employee turnover and attrition. As the integration

evolves and additional decisions about the identity and timing of closures are made, more current information will be available and assumptions used in

estimating the termination benefits accrual may change.

Transaction and integration expenses in 2014 include integration-related professional fees, incremental temporary contract labor, salary and benefits for

employees dedicated to Merger activity, travel costs, non-capitalizable software integration costs, and other direct costs to combine the companies. Expenses

in 2013 primarily relate to legal, accounting, and pre-merger integration activities incurred by Office Depot. Such costs are being recognized as incurred.

Other merger related expenses primarily relate to facility closure accruals, gains and losses on asset dispositions, and accelerated depreciation. Facility

closure expenses in 2014 include amounts incurred by the Company to close 168 retail stores in the United States as part of the Real Estate Strategy. An

additional 232 retail stores are expected to be closed through 2016. The specific sites to close over this period may be influenced by real estate and other

market conditions and, therefore, a reasonable estimate of future facility closure accruals cannot be made at this time.

Restructuring and certain other expenses in 2014 and 2013 primarily relate to international organizational changes and facility closures prior to the

European restructuring plan approved in October 2014 to realign the organization from a geographic-focus to a business channel-focus (the European

restructuring plan). The 2012 amounts include restructuring activities taken in North America as well as Europe and include severance accruals, facility

closure, and associated other costs.

The Company anticipates incurring incremental expenses associated with the European restructuring plan of approximately $120 million, $112 million of

which are cash expenditures. The expected $120 million of charges

79