OfficeMax 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

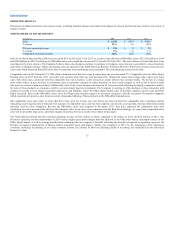

planned activities. For the fourth quarter 2014 impairment analysis, identified locations were reduced to estimated fair value of $1 million based on their

projected cash flows, discounted at 13% or estimated salvage value of $2 million, as appropriate. The Company continues to capitalize additions to

previously-impaired operating stores and tests for subsequent impairment. The 2014 store impairment charge also includes $1 million related to the closure

of stores in Canada.

The store impairment analysis for 2013 projected sales declines for several years, then stabilizing. Gross margin and operating cost assumptions were

consistent with actual results and planned activities. For the 2013 impairment analysis, identified locations were reduced to estimated fair value of $10

million based on their projected cash flows, discounted at 13% or estimated salvage value of $7 million, as appropriate.

A review of the North American Retail portfolio during 2012 concluded with a plan for each location to maintain its current configuration, downsize to either

small or mid-size format, relocate, remodel, renew or close at the end of the base lease term. The asset impairment analysis previously had assumed at least

one optional lease renewal. Additionally, projected sales trends included in the impairment calculation model in prior periods were reduced. These changes,

and continued store performance, served as a basis for the Company’s asset impairment review for 2012.

The Company will continue to evaluate initiatives to improve performance and lower operating costs. To the extent that forward-looking sales and operating

assumptions are not achieved and are subsequently reduced, or in certain circumstances, even if store performance is as anticipated, additional impairment

charges may result. However, at the end of 2014, the impairment analysis reflects the Company’s best estimate of future performance.

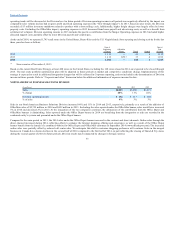

Software impairments

As part of the integration process during 2014, the Company decided to convert certain websites and other information technology applications to common

platforms resulting in $25 million related to the write off of capitalized software. Additionally, the Company abandoned a software project in Europe and

recognized impairment of the $28 million capitalized software.

Intangible assets

Following identification of retail stores for closure as part of our Real Estate Strategy, the related favorable lease assets recorded in the Merger were assessed

for accelerated amortization or impairment. Considerations included the projected cash flows discussed above, the net book value of operating assets and

favorable lease assets and related estimated favorable lease fair value. Impairment of $5 million was recognized during 2014. Additionally, the Company

decided to change the profile and expected life of a private brand trade name previously identified as having an indefinite life. The projected cash flow on a

relief from royalty measurement over the shortened estimated life resulted in a $5 million impairment charge.

The 2013 goodwill impairment of $44 million was triggered by the sale of our interest in Office Depot de Mexico. The related reporting unit of the

International Division included operating subsidiaries in Europe and ownership of the investment in Office Depot de Mexico. A substantial majority of the

estimated fair value of the reporting unit over its carrying value related to the joint venture. Following the July 2013 sale of our interest in Office Depot de

Mexico and return of cash proceeds to the U.S. parent company, the fair value of the reporting unit with goodwill decreased below its carrying value and

goodwill was fully impaired.

The 2012 impairment charge of $15 million related to intangible asset impairment associated with a prior acquisition of operations in Sweden that

experienced a downturn in performance and certain operational difficulties.

38