OfficeMax 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

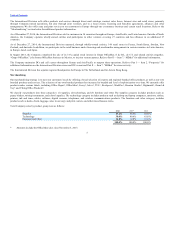

Table of Contents

In addition to risks and uncertainties in the ordinary course of business that are common to all businesses, important factors that are specific to our industry

and our Company could materially impact our future performance and results. We have provided below a list of risk factors that should be reviewed when

considering investing in our securities.

On February 4, 2015, we entered into the Staples Merger Agreement with Staples, a Delaware corporation and Staples AMS, Inc., a Delaware corporation and

a wholly owned subsidiary of Staples (“Merger Sub”), providing for, among other things, that, upon the terms and subject to the conditions set forth therein,

Merger Sub will merge with and into the Company, with the Company surviving as a wholly owned subsidiary of Staples. In connection with the proposed

merger, we are subject to certain risks including, but not limited to, those set forth below.

For additional information related to the Staples Merger Agreement, please refer to the Current Report on Form 8-K filed with the SEC on February 4, 2015

(the “Staples Merger Form 8-K”). The foregoing description of the Staples Merger Agreement is qualified in its entirety by reference to the full text of the

Merger Agreement attached as Exhibit 2.1 to the Staples Merger Form 8-K.

The announcement and pendency of the Staples Acquisition of our company with Staples could cause disruptions in and create uncertainty surrounding our

business, including affecting our relationships with our existing and future customers, suppliers and employees, which could have an adverse effect on our

business, results of operations and financial condition, regardless of whether the proposed Staples Acquisition is completed. In particular, we could

potentially lose important personnel as a result of the departure of employees who decide to pursue other opportunities in light of the Staples Acquisition.

We could also potentially lose customers or suppliers, and new customer or supplier contracts could be delayed or decreased. In addition, we have allocated,

and will continue to allocate, significant management resources towards the completion of the transaction, which could adversely affect our business and

results of operations.

We are subject to putative class action lawsuits challenging the Staples Acquisition. The lawsuits seek, among other things, to enjoin the consummation of

the Staples Acquisition, rescission of the Staples Acquisition if it is consummated, and an award of monetary damages, costs and fees. The costs, delay and

management resources associated with litigation related to the Staples Acquisition could adversely affect our business, results of operations and financial

condition.

We are also subject to restrictions on the conduct of our business prior to the consummation of the Staples Acquisition as provided in the Staples Merger

Agreement, including, among other things, certain restrictions on our ability to acquire other businesses, sell or transfer our assets, amend our organizational

documents, and incur indebtedness. These restrictions could result in our inability to respond effectively to competitive pressures, industry developments

and future opportunities and may otherwise harm our business, results of operations and financial condition.

There is no assurance that the closing of the Staples Acquisition will occur. Consummation of the Staples Acquisition is subject to various conditions,

including, among other things, the approval of the Staples Merger Agreement and the Staples Acquisition by the holders of a majority of our outstanding

shares of common stock,

11