Nokia 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

increased investment in services and software related intangible assets. Principal capital expenditures

during the three years included production lines, test equipment and computer hardware used

primarily in research and development, office and manufacturing facilities as well as services and

software related intangible assets. We expect the amount of capital expenditures (excluding

acquisitions) during 2009 to be reduced to approximately EUR 700 million, and to be funded from our

cash flow from operations.

Structured Finance

Structured finance includes customer financing and other thirdparty financing. Network operators in

some markets sometimes require their suppliers, including us, to arrange or provide longterm

financing as a condition to obtaining or bidding on infrastructure projects.

The current global financial crisis and the related tightening of the credit markets may restrict the

access of our customers and suppliers to financing. We do not, however, currently intend to

significantly increase financing to our customers which may have an adverse effect on our ability to

compete successfully for their business. Rather, as a strategic market requirement, we plan to

continue to arrange and facilitate financing to our customers, and provide financing and extended

payment terms to a small number of selected customers. Extended payment terms may continue to

result in a material aggregate amount of trade credits, but the associated risk is mitigated by the fact

that the portfolio relates to a variety of customers.

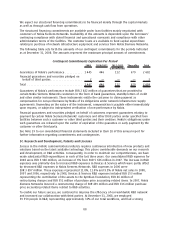

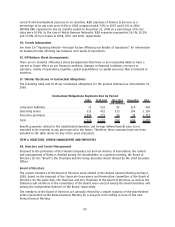

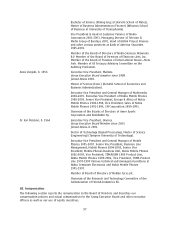

The following table sets forth our total structured finance, outstanding and committed, for the years

indicated.

Structured Finance

2008 2007 2006

At December 31,

(EUR millions)

Financing commitments .............................................. 197 270 164

Outstanding longterm loans (net of allowances and writeoffs) .............. 27 10 19

Current portion of outstanding longterm loans (net of allowances and

writeoffs) ....................................................... 101 156 —

Outstanding financial guarantees and securities pledged .................... 2 130 23

Total.............................................................. 327 566 206

In 2008, our total structured financing, outstanding and committed, decreased to EUR 327 million

from EUR 566 million in 2007 and primarily consisted of committed financing to network operators.

Outstanding financial guarantees given on behalf of third parties decreased to EUR 2 million in 2008

from EUR 130 million in 2007.

In 2007, our total structured financing, outstanding and committed, increased to EUR 566 million

from EUR 206 million in 2006 and primarily consisted of committed financing to network operators.

Outstanding financial guarantees given on behalf of third parties increased from EUR 23 million in

2006 to EUR 130 million in 2007.

See Note 35 (b) to our consolidated financial statements included in Item 18 of this annual report for

further information relating to our committed and outstanding customer financing.

As a strategic market requirement, we plan to continue to provide customer financing and extended

payment terms to a small number of selected customers. We continue to make arrangements with

financial institutions and investors to sell credit risk we have incurred from the commitments and

outstanding loans we have made as well as from the financial guarantees we have given. Should the

demand for customer finance increase in the future, we intend to further mitigate our total structured

financing exposure, market conditions permitting.

87