Nokia 2008 Annual Report Download - page 167

Download and view the complete annual report

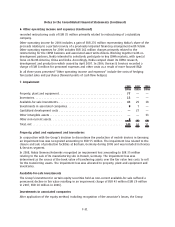

Please find page 167 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

differences in functional currency not presentation currency, and hedging instruments may be held

anywhere in the group.

IFRIC 18 Transfers of Assets from Customers clarifies the requirements for agreements in which an

entity receives an item of property, plant and equipment or cash it is required to use to construct or

acquire an item of property, plant and equipment that must be used to provide access to a supply of

goods or services.

IFRS 3 (revised) Business Combinations replaces IFRS 3 (as issued in 2004). The main changes brought

by IFRS 3 (revised) include immediate recognition of all acquisitionrelated costs in profit or loss,

recognition of subsequent changes in the fair value of contingent consideration in accordance with

other IFRSs and measurement of goodwill arising from step acquisitions at the acquisition date.

IAS 27 (revised), “Consolidated and Separate Financial Statements” clarifies presentation of changes in

parentsubsidiary ownership. Changes in a parent’s ownership interest in a subsidiary that do not

result in the loss of control must be accounted for exclusively within equity. If a parent loses control

of a subsidiary it shall derecognize the consolidated assets and liabilities, and any investment

retained in the former subsidiary shall be recognized at fair value at the date when control is lost.

Any differences resulting from this shall be recognized in profit or loss. When losses attributed to the

minority (noncontrolling) interests exceed the minority’s interest in the subsidiary’s equity, these

losses shall be allocated to the noncontrolling interests even if this results in a deficit balance.

In addition, there are a number of other amendments that form part of the IASB’s annual

improvement project, which will be adopted by the Group on January 1, 2009.

The Group will adopt the amendments to IFRS 2, IAS 1, IAS 20, IAS 23, IAS 32, IFRIC 13, IFRIC 16 and

IFRIC 18 as well as the additional amendments that form part of the IASB’s annual improvement

project on January 1, 2009. The Group does not expect that the adoption of these revised standards,

interpretations and amendments will have a material impact on the financial condition and results of

operations.

The Group is required to adopt both IFRS 3 (revised) and IAS 27 (revised) on January 1, 2010 with

early adoption permitted. The Group is currently evaluating the impact of these standards on the

Group’s accounts.

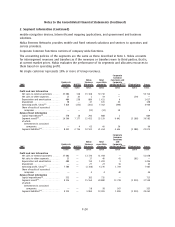

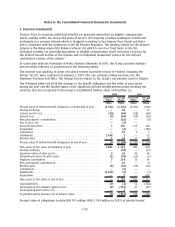

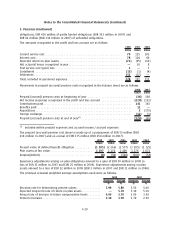

2. Segment information

As of January 1, 2008, the Group’s three mobile device business groups and the supporting horizontal

groups have been replaced by an integrated business segment, Devices & Services. Devices & Services

and Nokia Siemens Networks are each reportable segments for financial reporting purposes.

Commencing with the third quarter 2008, NAVTEQ is also a reportable segment. Prior period results

for Nokia and its reportable segments have been regrouped for comparabality purposes according to

the new reportable segments effective in 2008.

Nokia is organized on a worldwide basis into three reportable segments: Devices & Services, NAVTEQ,

and Networks. Nokia’s reportable segments represent the strategic business units that offer different

products and services for which monthly financial information is provided to the chief operating

decisionmaker.

Devices & Services segment is responsible for developing and managing the Group’s portfolio of

mobile devices and consumer Internet services, as well as the management of our supply chains,

sales channels, brand and marketing activities.

NAVTEQ is a leading provider of comprehensive digital map information for automotive systems,

F23

Notes to the Consolidated Financial Statements (Continued)