Nokia 2008 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35. Risk Management (Continued)

estimate of incurred losses. All receivables and loans due from customers and other third parties are

considered on an individual basis for impairment testing.

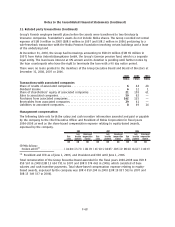

Top three customers account for approximately 4.0%, 3.8% and 3.5% (2007: 4.9%, 2.9% and 2.5%) of

Group accounts receivable and loans due from customers and other third parties as at December 31,

2008 while the top three credit exposures by country amounted to 8.5%, 7.2% and 7.2% (2007: 8.7%,

6.9% and 6.5% ) respectively.

As at December 31, 2008, the carrying amount before deducting any impairment allowance of

accounts receivable relating to customers for which an impairment was provided amounted to

EUR 3 042 million (2007: EUR 3 011 million). The amount of provision taken against that portion of

these receivables considered to be impaired was EUR 415 million (2007: EUR 332 million) (see also

note 19 Valuation and qualifying accounts).

An amount of EUR 729 million (2007: EUR 478 million) relates to past due receivables from customers

for which no impairment loss was recognized. The aging of these receivables is as follows:

2008 2007

EURm EURm

Past due 130 days ....................................................... 453 411

Past due 31180 days ..................................................... 240 66

More than 180 days ....................................................... 36 1

729 478

As at December 31, 2008, the carrying amount before deducting any impairment allowance of loans

due from customers and other third parties for which impairment was provided amounted to

EUR 4 million (2007: EUR 161 million). The amount of provision taken for these loans was

EUR 4 million (2007: EUR 19 million).

There were no past due loans due from customers and other third parties.

Financial Credit Risk

Financial instruments contain an element of risk of loss resulting from counterparties being unable to

meet their obligations. This risk is measured and monitored centrally. Nokia manages financial credit

risk actively by limiting its counterparties to a sufficient number of major banks and financial

institutions and monitoring the credit worthiness and exposure sizes continuously as well as through

entering into netting arrangements (which gives Nokia the right to offset in the event that the

counterparty would not be able to fulfill the obligations) with all major counterparties and collateral

agreements (which require counterparties to post collateral against derivative receivables) with

certain counterparties.

Nokia’s investment decisions are based on strict creditworthiness and maturity criteria as defined in

the Treasury Policy and Operating Procedure. Due to global banking crisis and the freezing of the

credit markets in 2008, Nokia applied an even more defensive approach than usual within Treasury

Policy towards investments and counterparty quality and maturities, focusing on capital preservation

and liquidity. As result of this investment policy approach and active management of outstanding

investments exposures, Nokia has not been subject to any material credit losses in its financial

investments.

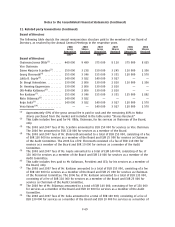

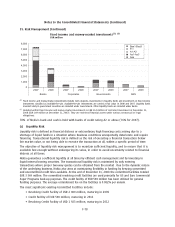

The table below presents the breakdown of the outstanding availableforsale fixed income and

money market investments by sector and credit rating grades ranked as per Moody’s rating

categories.

F77

Notes to the Consolidated Financial Statements (Continued)