Nokia 2008 Annual Report Download - page 158

Download and view the complete annual report

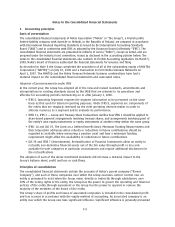

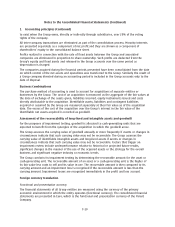

Please find page 158 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

Financial assets

The Group has classified its financial assets as one of the following categories: availableforsale

investments, loans and receivables, bank and cash and financial assets at fair value through profit or

loss.

Availableforsale investments

The Group classifies the following investments as available for sale based on the purpose for

acquiring the investments as well as ongoing intentions: (1) highly liquid, interestbearing

investments with maturities at acquisition of less than 3 months, which are classified in the balance

sheet as current availableforsale investments, cash equivalents, (2) similar types of investments as

in category (1), but with maturities at acquisition of longer than 3 months, classified in the balance

sheet as current availableforsale investments, liquid assets, (3) investments in technology related

publicly quoted equity shares, or unlisted private equity shares and unlisted funds, classified in the

balance sheet as noncurrent availableforsale investments.

Current fixed income and moneymarket investments are fair valued by using quoted market rates,

discounted cash flow analyses and other appropriate valuation models at the balance sheet date.

Investments in publicly quoted equity shares are measured at fair value using exchange quoted bid

prices. Other available for sale investments carried at fair value include holdings in unlisted shares.

Fair value is estimated by using various factors, including, but not limited to: (1) the current market

value of similar instruments, (2) prices established from a recent arm’s length financing transaction of

the target companies, (3) analysis of market prospects and operating performance of the target

companies taking into consideration the public market of comparable companies in similar industry

sectors. The remaining available for sale investments are carried at cost less impairment, which are

technology related investments in private equity shares and unlisted funds for which the fair value

cannot be measured reliably due to nonexistence of public markets or reliable valuation methods

against which to value these assets. The investment and disposal decisions on these investments are

business driven.

All purchases and sales of investments are recorded on the trade date, which is the date that the

Group commits to purchase or sell the asset.

The fair value changes of availableforsale investments are recognized in fair value and other

reserves as part of shareholders’ equity, with the exception of interest calculated using effective

interest method and foreign exchange gains and losses on monetary assets, which are recognized

directly in profit and loss. Dividends on available for sale equity instruments are recognized in profit

and loss when the Group’s right to receive payment is established. When the investment is disposed

of, the related accumulated fair value changes are released from shareholders’ equity and recognized

in the profit and loss account. The weighted average method is used when determining the costbasis

of publicly listed equities being disposed of. FIFO (Firstin Firstout) method is used to determine the

cost basis of fixed income securities being disposed of. An impairment is recorded when the carrying

amount of an availableforsale investment is greater than the estimated fair value and there is

objective evidence that the asset is impaired including but not limited to counterparty default and

other factors causing a reduction in value that can be considered permanent. The cumulative net loss

relating to that investment is removed from equity and recognized in the profit and loss account for

the period. If, in a subsequent period, the fair value of the investment in a nonequity instrument

increases and the increase can be objectively related to an event occurring after the loss was

recognized, the loss is reversed, with the amount of the reversal included in the profit and loss

account.

F14

Notes to the Consolidated Financial Statements (Continued)